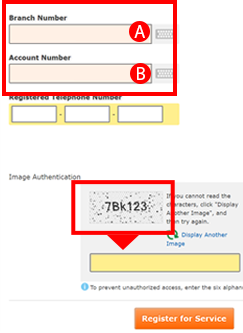

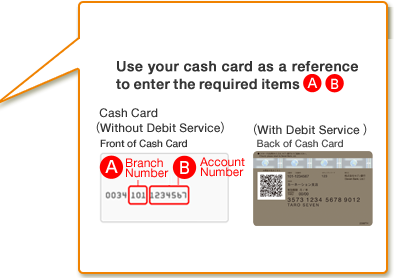

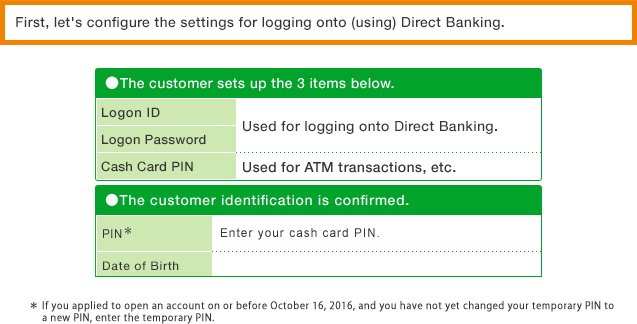

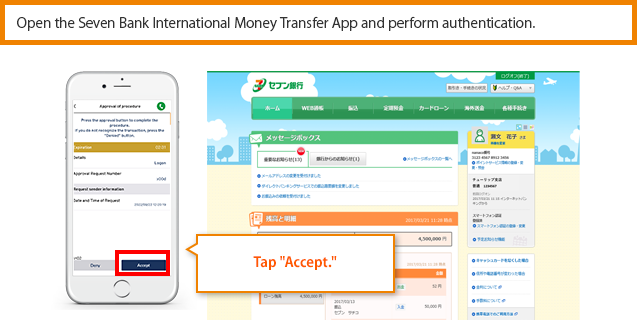

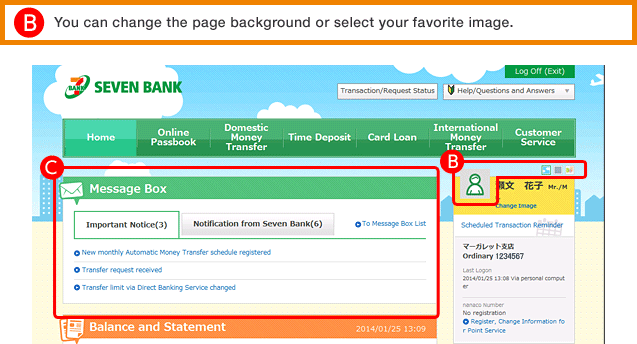

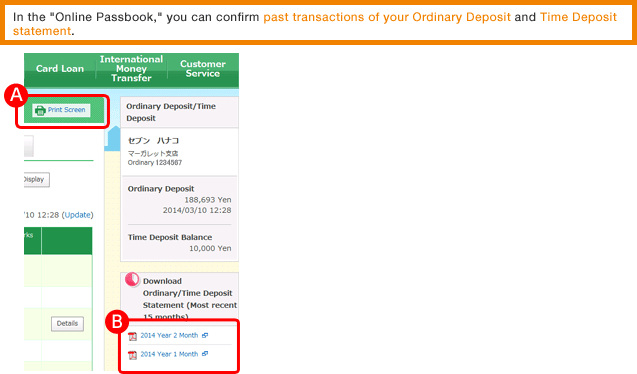

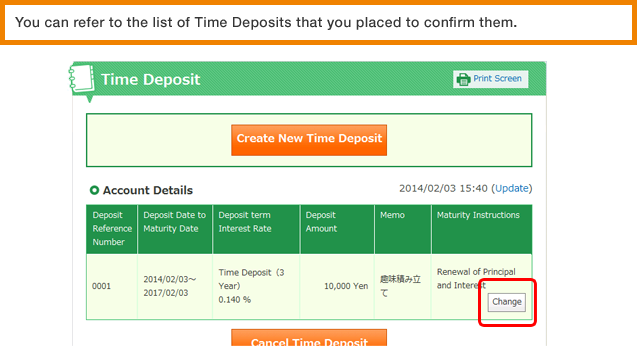

Guide to Using the Direct Banking Service

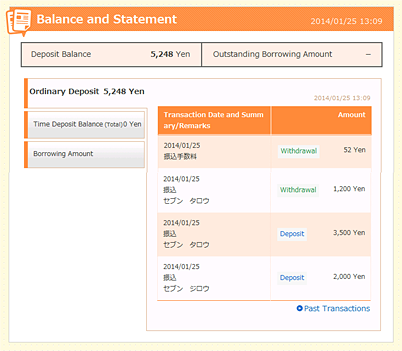

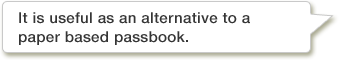

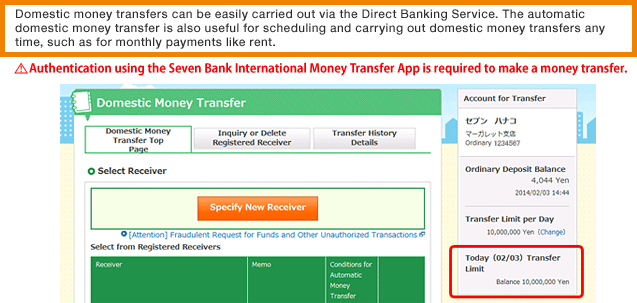

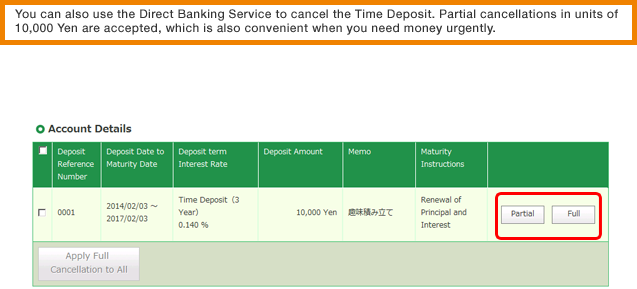

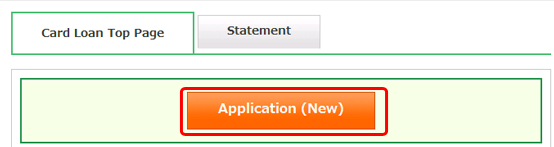

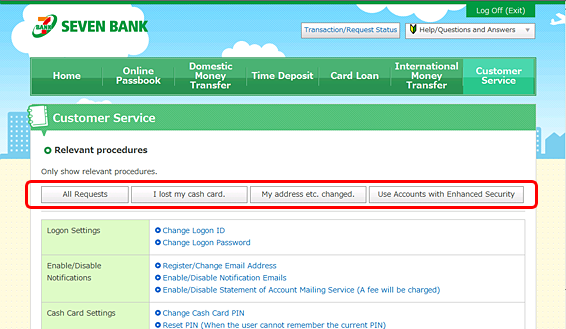

The Direct Banking Service provides a variety of services, such as transactions (balance inquiry and domestic money transfer) or Customer Services via your PC and smartphone.

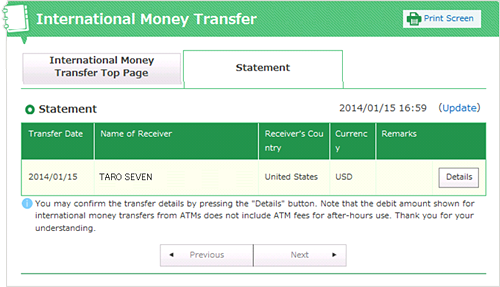

After selecting a service from the menu below to learn about its content, the usage instructions can be confirmed from the slide.