Risk Management Initiatives

The purpose of Seven Bank’s risk management is to ensure healthy and effi cient management as aiming at an improvement in corporate value by appropriately managing various kinds of risks related to management.

Risk Management System

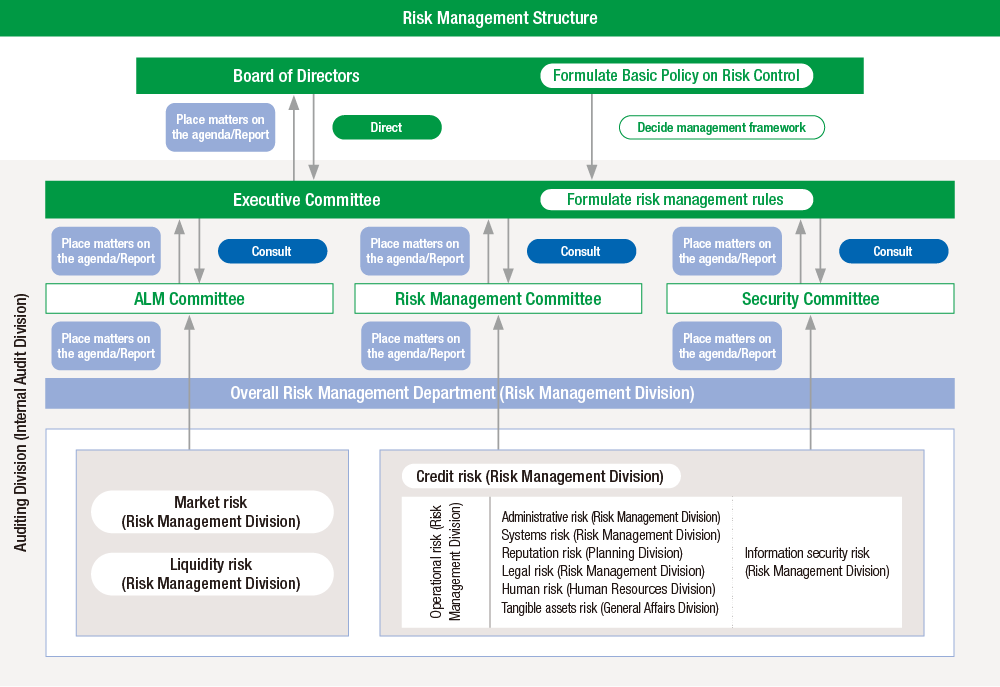

Every fiscal year, the Board of Directors establishes the “Basic Policy on Risk Control,” which specifies the overall risk management policy, specific risk management policies and the organization and system for risk management. In accordance with this policy, the Executive Committee establishes detailed rules and regulations related to risk management and confirms the Companywide risk status every quarter. The Bank’s risk management structure includes the Risk Management Division, which is responsible for supervising overall risk management activities, specific risk management divisions and the Internal Audit Division to perform internal audits. We have also established the Risk Management Committee and the Security Committee, chaired by the officer in charge of the Risk Management Division, and the Asset-Liability Management (ALM) Committee, chaired by the officer in charge of the Planning Division, as advisory bodies to the Executive Committee concerning risk management.

In FY2022, in light of the increase in the number of consolidated subsidiaries and expansion of our business, we strengthened the Seven Bank Group’s risk management system.

Overall Management of Risk

The Bank observes its basic policies relating to overall risk management, which are governed by the Basic Policy on Risk Control and Overall Risk Management Rules, established under the policy. We gain an over all grasp of our risks including climate changes by assessing each of the Bank’s risk categories and manage them by comparing them with our equity.

Credit Risk

Currently, our risk management activities relating to credit risk are limited to the ATM settlement business, the ALM of interbank deposits placed with top-rated partner fi nancial institutions, bonds, the lending of funds in the call-money market, temporary ATM payment amounts due and small personal loans, to minimize credit risk. In addition, the Bank performs self-assessment of asset quality as appropriate and establishes an allowance for credit losses in accordance with its self-assessment and reserve rules.

Market Risk

It is stipulated that the limits on the maximum level of funds at risk, the market position limits and the loss allowance limits shall be set. The Risk Management Division measures and monitors market risk on a daily basis in light of these limits and reports the results to management, including the Executive Committee. At the ALM Committee meeting held every quarter, the Bank’s market risk position, expected trends in interest rates and other matters are reported and the policy for the ALM operation is determined.

Liquidity Risk

It is stipulated that the limits regarding the cash gaps arising from differences between the period of the management of invested funds and the timing of the liquidation shall be set. The Risk Management Division measures and monitors liquidity risk on a daily basis in light of these limits and reports the results to management, including the Executive Committee. To prepare for emergency events requiring immediate funding, the Bank has devised preemptive comprehensive countermeasures to be able to take quick and fl exible Companywide action by risk scenario, and therefore does not expect to experience a major liquidity problem.

Operational Risk

Recognizing that operational risks may come to the surface in all business divisions, the Bank has established the structure to identify, evaluate, monitor, control, and reduce risks. Risk categories are as follows.

- ・ Administrative Risk

- ・ Systems Risk

- ・ Information Security

- ・ Risk Reputation Risk

- ・ Legal Risk

- ・ Human Risk

- ・ Tangible Assets Risk

Management System of Information Security Risk

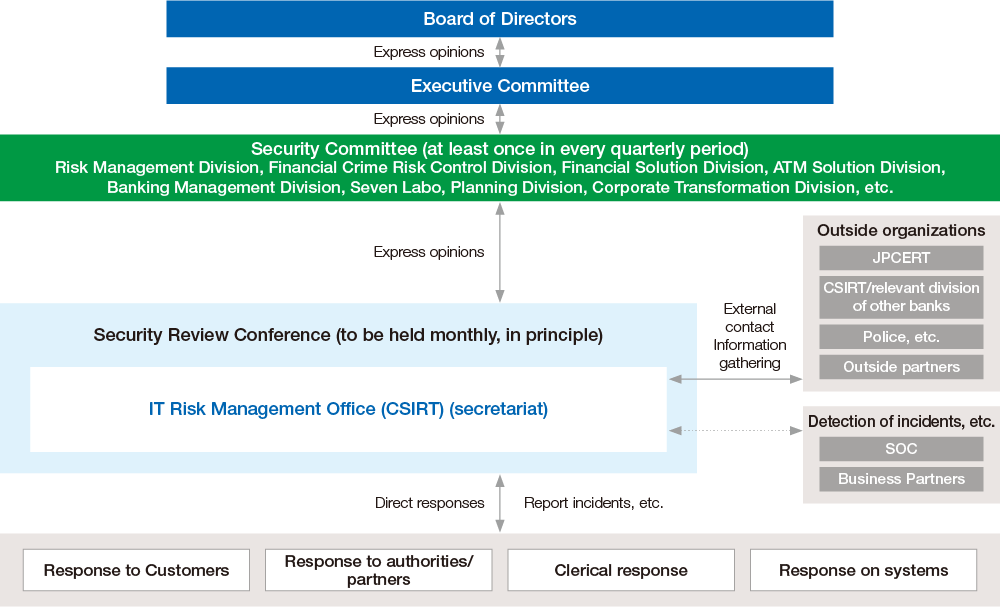

With the further progression of IT, as attacks targeting at broader areas of services and systems are necessitating appropriate measures to ensure security, we have established a dedicated team for cyber security management in order to protect the Group’s information assets such as customer information from various threats. We have established Cybersecurity Risk Rules while enhancing our structure for security management, which include holding Security Committee meetings at least once in every quarterly period to discuss effective security measures.

Initiatives for Enhancing Cyber Security

The dedicated team for cyber security management is in charge of the Bank-wide management of cybersecurity risks, composed of members from multiple divisions. The team widely responds to attacks to the Bank’s services and systems, including cyber attacks, skimming, fake cards, unauthorized access, and information leakage.

Believing the balanced combination of human resources, mechanism, and technology is necessary to maintain security, the Bank is working on each of them.

- Human resources:

- Create security-conscious corporate culture, develop personnel for security, conduct trainings and drills

- Mechanism:

- Improve rules/procedures on which governance is based, practice Security by Design

- Technology:

- Respond to results of the Bank-wide security diagnosis

Cyber Security Structure

Establishment of Business Continuity Plan (BCP)

To fulfill our social responsibility as a bank, Seven Bank has defined the following three operations as top priorities for continuity in the event of a disaster, large-scale accident, or other crisis: the ATM business; the fund settlement business serving banks and ATM partners; and withdrawals from the Bank’s accounts and money transfer operations. Each division has also created a Business Continuity Plan (BCP) to enable continuity of these essential operations in the event of an accident, disaster, or other crisis. To further ensure the business continuity, each division regularly conducts the business continuity training, envisioning damage to data centers and other facilities.

- Management information

- Message from the President

- Management Policy, Management Environment, and Issues to be Addressed,etc.

- Risk Factors

- Risk Management Initiatives

- Compliance Initiatives

- Medium-Term Management Plan FY21-FY25

- Stock and bond information

- Stock Information

- Dividends and Shareholders Returns Policy

- Corporate Bond and Rating Information

- General Meeting of Shareholders

- IR Library

- IR News

- Financial Statements

- IR Presentations

- IR Calendar

- Annual report

- Seven Bank Disclosure Policy

- Other Corporate Information

- Company

- Sustainability