Social issues to be addressed

Major changes are underway in the financial environment. The provision of a safe and secure settlement infrastructure is now one of the most important issues against the backdrop of the growth of digital payments in addition to the increasing sophistication and ingenuity of financial crimes and increase in cyber attacks. In addition, with the increasing severity of damage caused by natural disasters, there is a need to establish and support a safe and secure infrastructure for people’s lives.

Vision

Seven Bank will provide diverse services that are available at any time in daily life by building a security system that is solid whether at normal times or in an emergency, as well as an organization and structure to minimize operation suspensions in the event of an emergency, to become a social infrastructure that provides safety and security to society.

Realize non-stop social infrastructure

Our Initiatives Behind Non-stop ATM

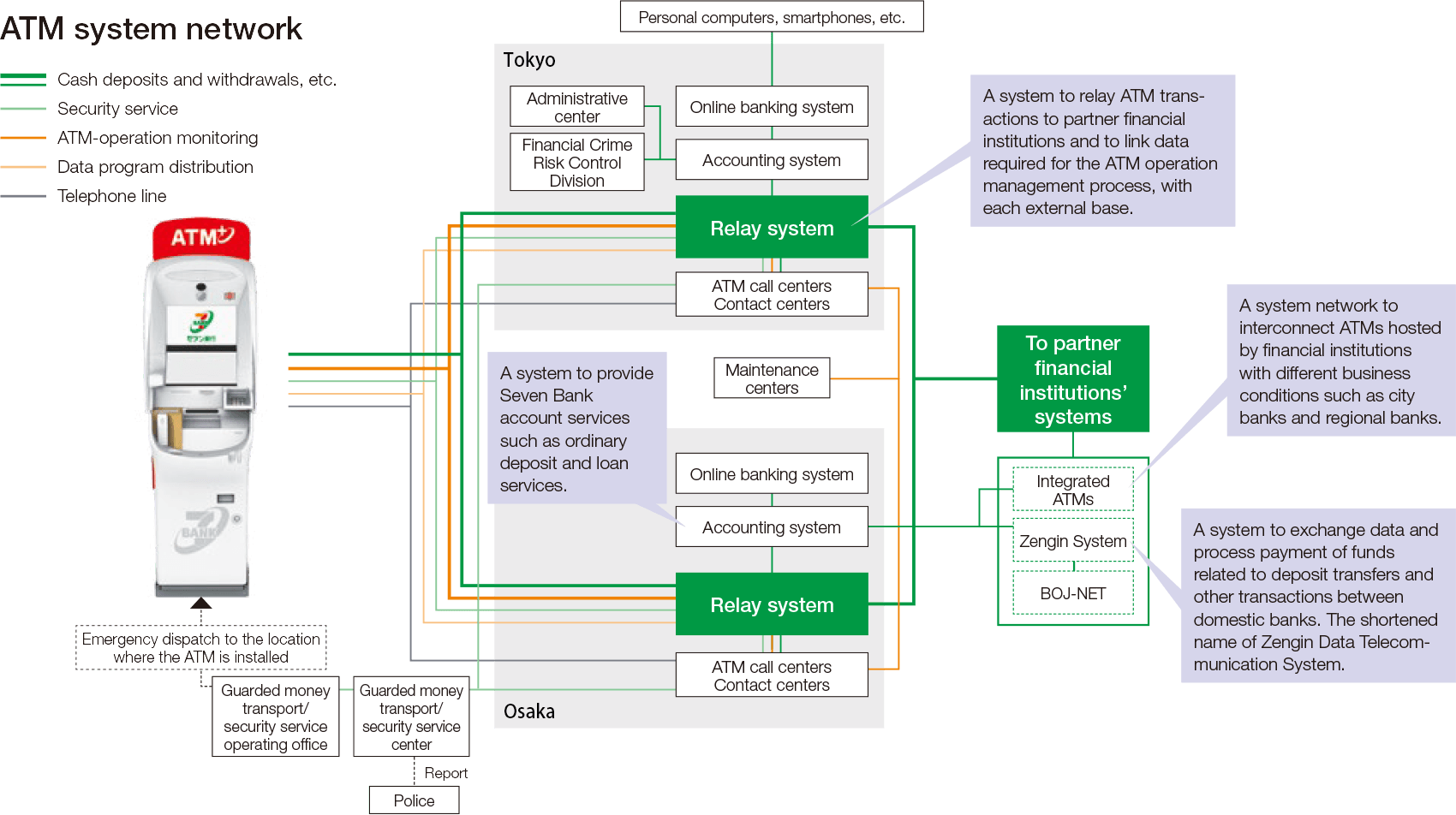

Seven Bank has established the safe and secure ATM network which is always available in customers’ daily life to support providing various convenient services.

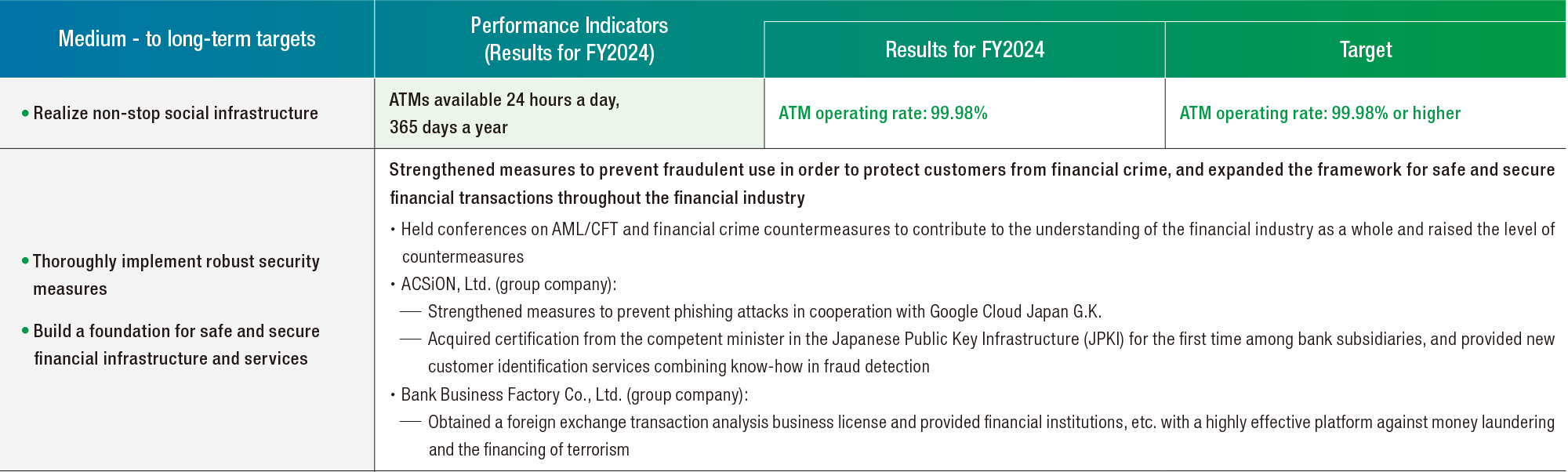

The following initiatives have enabled us to achieve a 99.98% utilization rate for the 28,000 ATMs we have installed nationwide.

● Duplicated system bases

The operation of our critical systems and functions are duplicated in our eastern and western bases in Japan, which allows us to provide “non-stop ATM” service, services available for 24 hours a day, 365 days a year. This also enables us to establish a structure to continue our business in one of the two bases in case of a major disaster in the other base.

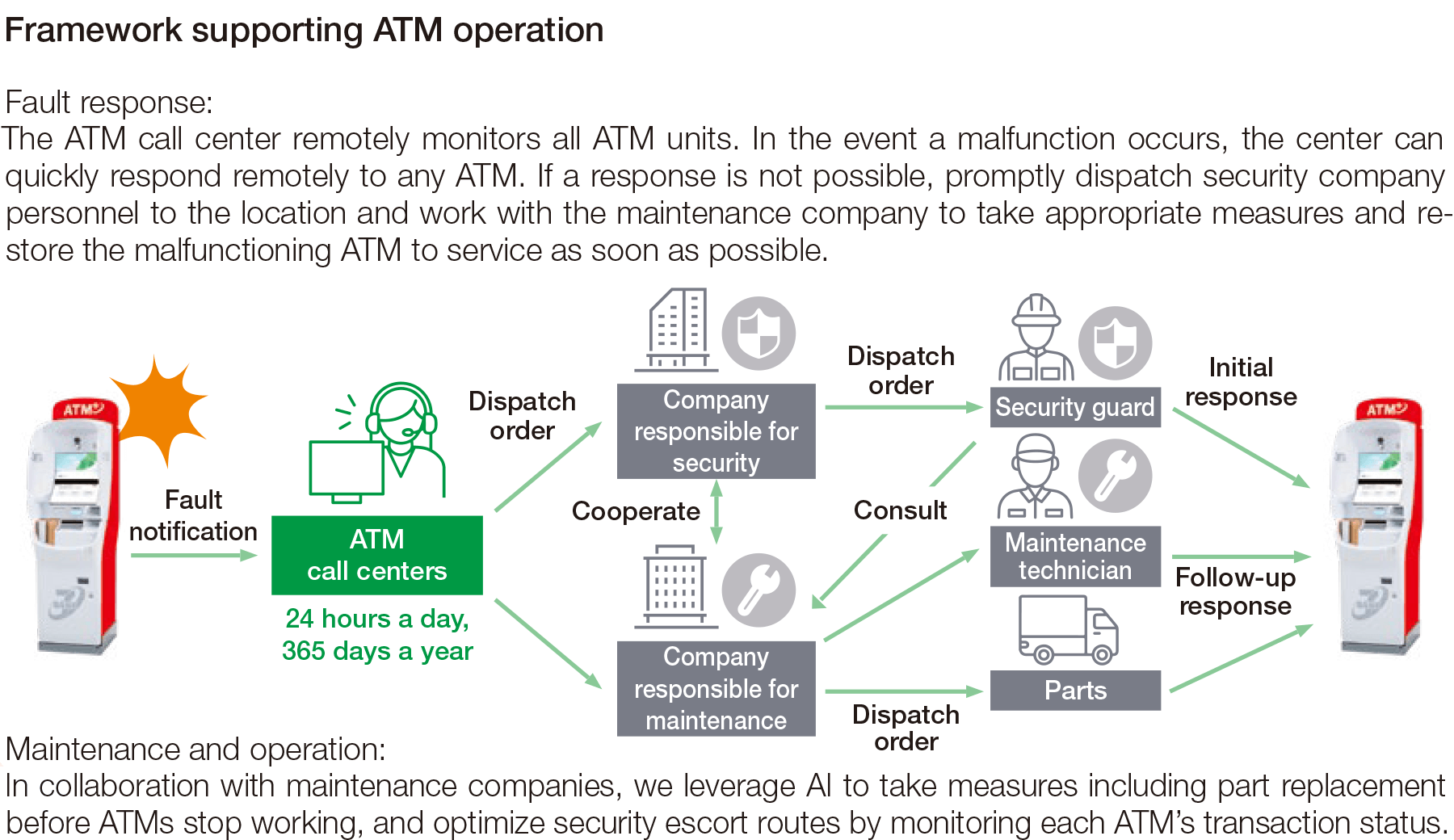

● Prevention and speedy recovery of out of cash and system failure incidents

In collaboration with our partner companies, all ATMs and the network are under manned live monitoring to ensure stable operation.

If unpredicted service outages arise, a maintenance specialist with expertise arrives on site and works towards immediate recovery.

Our wide range of initiatives includes the use of AI technology to predict demand for cash stored in ATMs responding to the changing payment needs, and preventative maintenance to predict the failure of different components.

Disaster Support

After the Great East Japan Earthquake in March 2011, we dispatched mobile ATM vehicles to regions where considerable time was required to resume ATM businesses.

From October 2015 to March 2016, we regularly dispatched mobile ATM vehicles to Katsurao Village, Fukushima Prefecture, which is designated as an evacuation zone due to the Fukushima Daiichi Nuclear Accident, to support the reconstruction of the region.

Thoroughly implement robust information security measures Build a foundation for safe and secure financial infrastructure and services

For Ensuring Security for Customers Using ATMs

Seven Bank’s ATMs are provided with measures against peeking at the keypad to make PINs or transaction amounts unviewable by others. These ATMs also display and sound alerts to prevent bank transfer fraud when customers attempt to transfer money. We also take measures to detect any suspicious object attached to an ATM and unusual transactions as well as to prevent fraudulent acquisition of credit card information (skimming) at all times.

Our customer management continues even after the opening deposit accounts to prevent fraudulent use of accounts and ensure secure use for customers, aiming for maintaining up-to-date customer information. New ATMs allow our customers to respond easily and comfortably using “+Connect” functions of “ATM Notification” and “ATM Teller.” This allows us to receive more customer responses compared to the traditional way

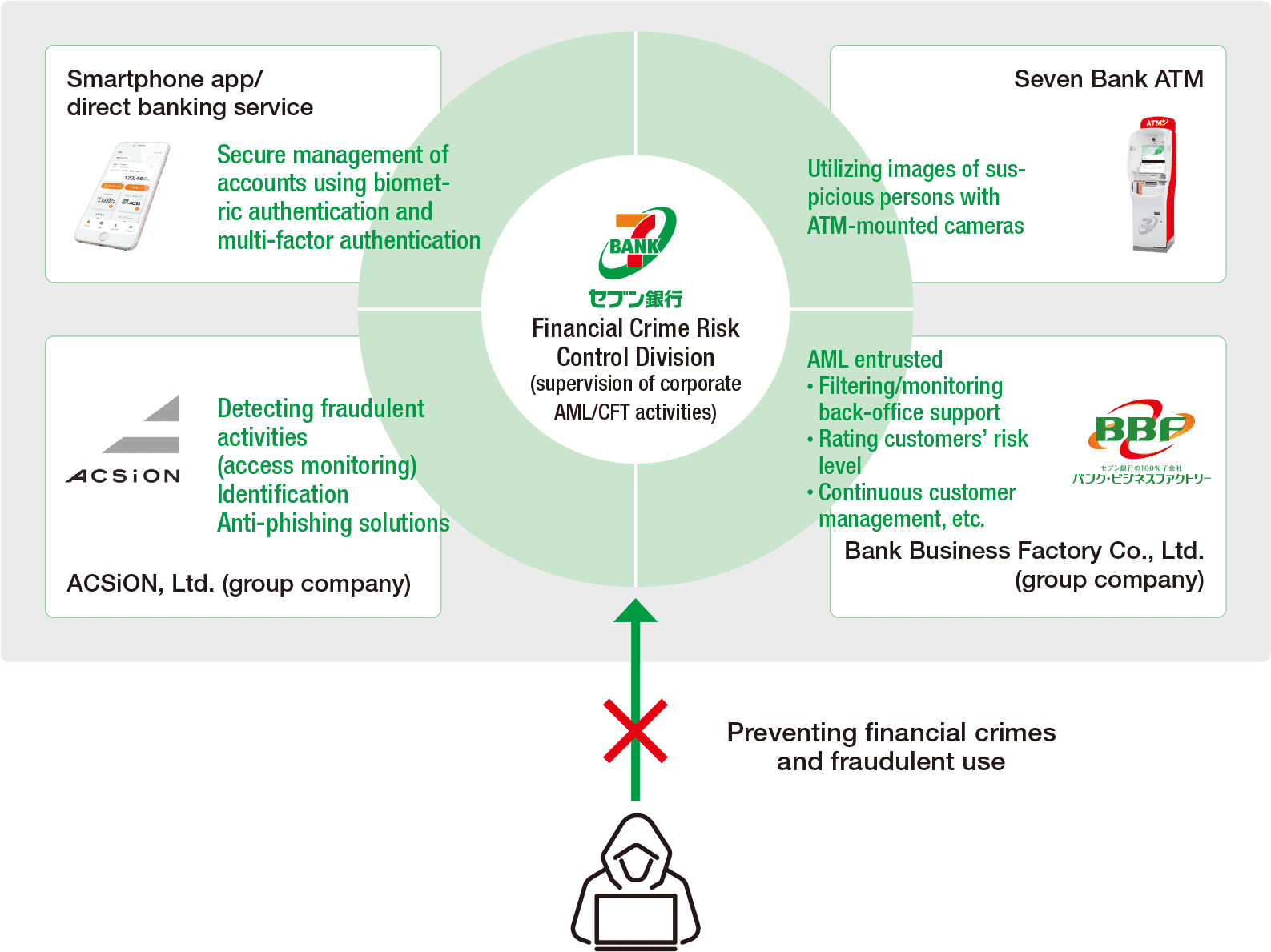

Prevention of Financial Crimes

Seven Bank Group is actively working to prevent financial crimes to ensure all customers can use its services securely by leveraging the know-how it has accumulated in financial crime prevention, a network of about 28,000 ATMs across Japan, and the Seven Bank Group’s expertise in developing IT solutions.

Recently, financial crimes and fraudulent transactions targeting customers are becoming increasingly crafty and frequent. Seven Bank, recognizing the specialty of its banking business based on non-face-to-face transactions primarily through ATMs, has established the Financial Crime Risk Control Division as a dedicated unit to combat financial crimes. The division focuses on preventing financial crimes and protecting customers’ assets in order to ensure that customers can use the bank’s services with security. The division works against money laundering, terrorism financing (AML/CFT),, and proliferation financing, eliminates fraudulent accounts, detects and prevents special fraud, etc., and provides appropriate cooperation with the police and other investigative agencies, by monitoring and filtering transactions and monitoring information on unauthorized use in cooperation with other divisions and Group companies.

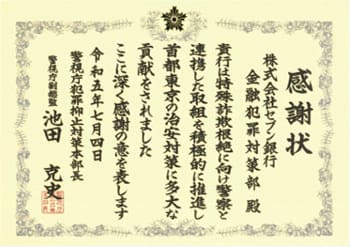

Cooperation with the Police, Public Bodies, Partner Financial Institutions, etc

Seven Bank has contributed to the detection of financial crimes in more than 120,000 cases a year nationwide, by cooperating with public bodies including the police and the Regional Taxation Bureaus and bar associations, which includes providing information about ATM camera images and account transactions upon their requests.

In addition, we are seeking to strengthen our relationships with external parties and are willing to mutually utilize and accumulate know-how from each other, for example, by sharing information with criminal investigation bodies and financial crime prevention staff from partner financial institutions.

- Seven Bank’s Sustainability

- Top Message

- Sustainability Management

- ESG

- Environment

- Social

- Corporate Governance

- Materiality

- Materiality top

- Fundamental value

Offer a social infrastructure available anytime with safety and security - Social value

Realize a wide variety of services accessible to anyone, anywhere - Creation of new values

Create unique values beyond our customers’ expectations - Source of value creation

Create a society where everyone can be active - Value creation for the future

Contribute to the prosperity of our society and the future of the Earth

- Social Contribution Activities

- For Future Generations

- Social Contribution Activities

- Other Corporate Information

- Investor Relations

- Company