Social issues to be addressed

The evolution of digital technology and lifestyle changes are making customers’ values and needs more diverse than before. In addition to providing highly convenient financial services that meet the needs of individual customers, we are also required to build relationships with customers through providing new customer experiences.

Vision

On top of the basis of “being close-by and convenient” and “safety and security,” through the development of new “retail x finance” services out of the box of conventional financial services, we will create new value that will connect us with customers in their daily lives

Realize a multicultural symbiotic society

For an easy-to-live daily life

We offer multilingual services that include international money transfer services tailored to the needs of foreign nationals residing in Japan, and services that allow customers to easily open an account at an ATM.

We launched a service in December 2024 that enables foreign nationals living in Japan for work or study to open bank accounts via ATMs. More than 3,000 accounts had been opened through this service by the end of FY2024.

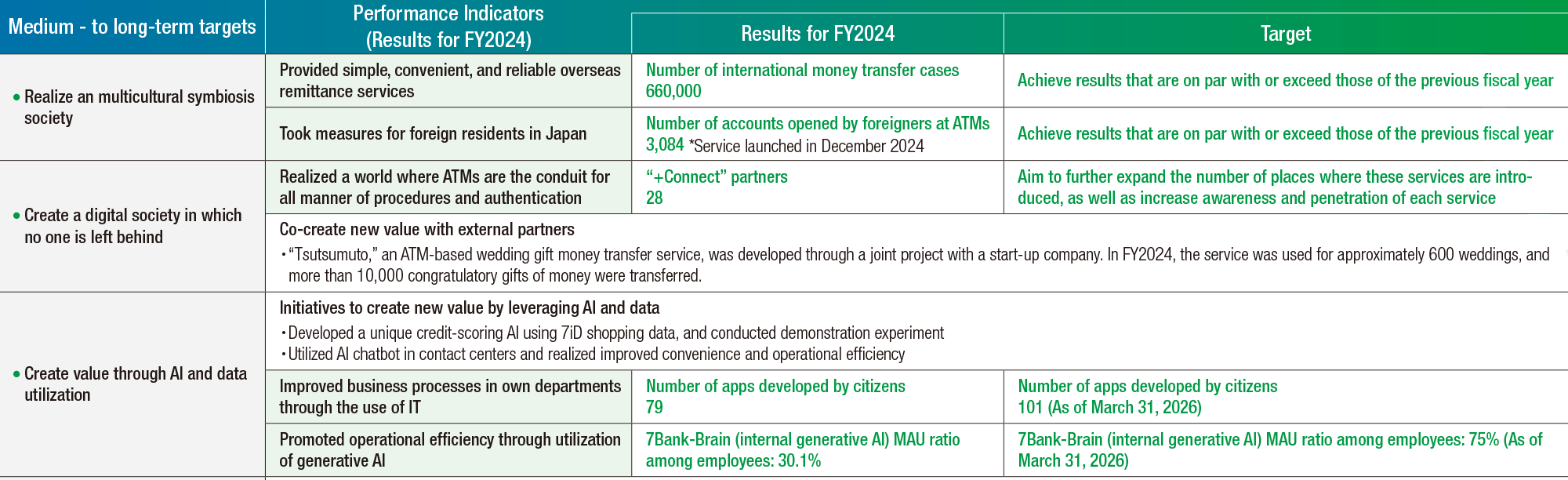

Seven Bank ATMs Support 12 Languages

In order to support the many people who have come to Japan for tourism and other reasons and ensure their comfortable stay, we provide a service at all Seven Bank ATMs nationwide which makes it possible to withdraw Japanese yen using cash cards and credit cards issued overseas.

Our ATMs can be used in 12 languages (Japanese, English, Chinese [simplified], Chinese [traditional], Korean, Thai, Malaysian, Indonesian, Vietnamese, French, German, and Portuguese). We will continue to strive for an advanced service available for anyone and from any location.

Multilingual Seven Bank Account Service

Seven Bank account services are available in multiple languages to allow a wide range of customers to take advantage of our services with peace of mind. ATM operation screens for Seven Bank account deposits and withdrawals, as well as international money transfer services are available in nine languages (Japanese, English, Tagalog, Chinese, Portuguese, Spanish, Vietnamese, Indonesian, and Thai). Support services for inquiries on Seven Bank accounts are available in 10 languages, with Burmese added to the above nine languages at the contact center. We will continue to strive to enhance the customer convenience of our services.

Create a digital society in which no one is left behind

Realized a world where ATMs are the conduit for all manner of procedures and authentication

+Connect is a convenient service provided to a wide range of industries, including banks, non-banks, operating companies and governments, with the aim of the world of “Seven Bank ATMs the conduit for all manner of authentication and procedures.” It has been used as a new customer contact channel to help partners address their business issues and resolve various “negatives” that could not be resolved by conventional means such as mailing. It was introduced to more than 25 partners within one and a half years after its release.

In February 2025, we introduced FACE CASH, a cash deposit and withdrawal service utilizing facial recognition, providing customers with a new financial experience that merges convenience and security.

Promoting open innovation

With a core role played by Seven Labo in this arena, every day, we search for external knowledge that is vital for creating innovation, and work with external partners to co-create various values.

The ATM-based gift collection service “Tsutsumuto,” developed through a co-creation project with a startup, was used for approximately 600 weddings in FY2024, with gift collections surpassing 10,000.

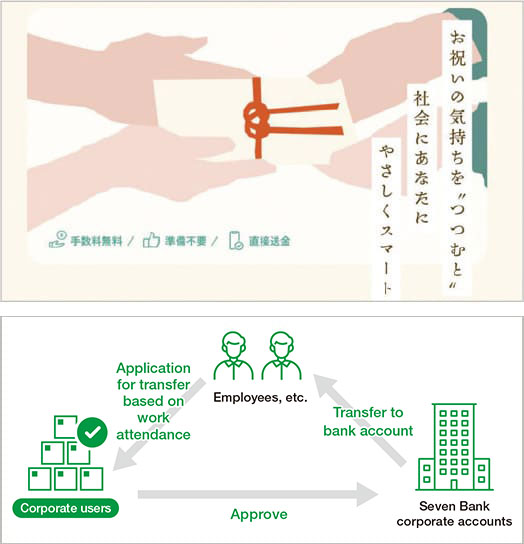

In addition, real-time money transfer service, which API integration makes possible basically 24 hours a day, 365 days a year, is also a service born from the New Business Creation Program (Accelerator) and is used for various purposes such as advance salary payment, immediate payment, and payment of business remuneration.

Create value through AI and data utilization

Various initiatives utilizing AI and data

We have launched a unique retail x financial initiative that leverages purchase data from 7iD, a service used at Seven-Eleven and other stores, for personal loan services, making possible credit screening from a new perspective. Moreover, we are accelerating internal efforts to enable general employees to use various data and develop business applications, resulting in enhanced productivity and a transition to higher value-added work.

- Seven Bank’s Sustainability

- Top Message

- Sustainability Management

- ESG

- Environment

- Social

- Corporate Governance

- Materiality

- Materiality top

- Fundamental value

Offer a social infrastructure available anytime with safety and security - Social value

Realize a wide variety of services accessible to anyone, anywhere - Creation of new values

Create unique values beyond our customers’ expectations - Source of value creation

Create a society where everyone can be active - Value creation for the future

Contribute to the prosperity of our society and the future of the Earth

- Social Contribution Activities

- For Future Generations

- Social Contribution Activities

- Other Corporate Information

- Investor Relations

- Company