Social issues to be addressed

In order to address issues caused by regional disparities and the digital divide (information gap), it is essential to build alternative social and information infrastructure. Driving DX across society through closer cooperation between the public and private sectors will lead to realizing a world where people of any age in any region can access the services they need.

Vision

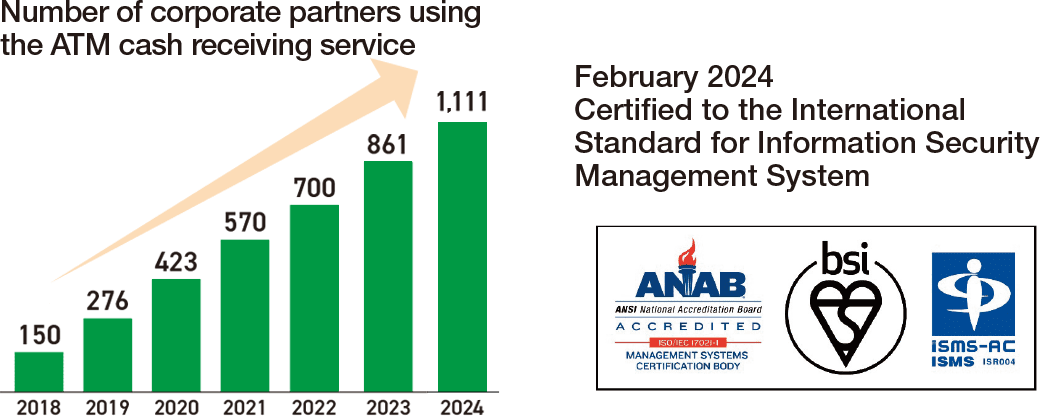

Aiming to be “the most user-friendly digital channel in society,” through a network of over 50,000 ATMs in five countries around the world, we will establish a social infrastructure accessible to anyone, anytime and anywhere to provide a variety of services needed by users.

Seven Bank's Major Initiatives

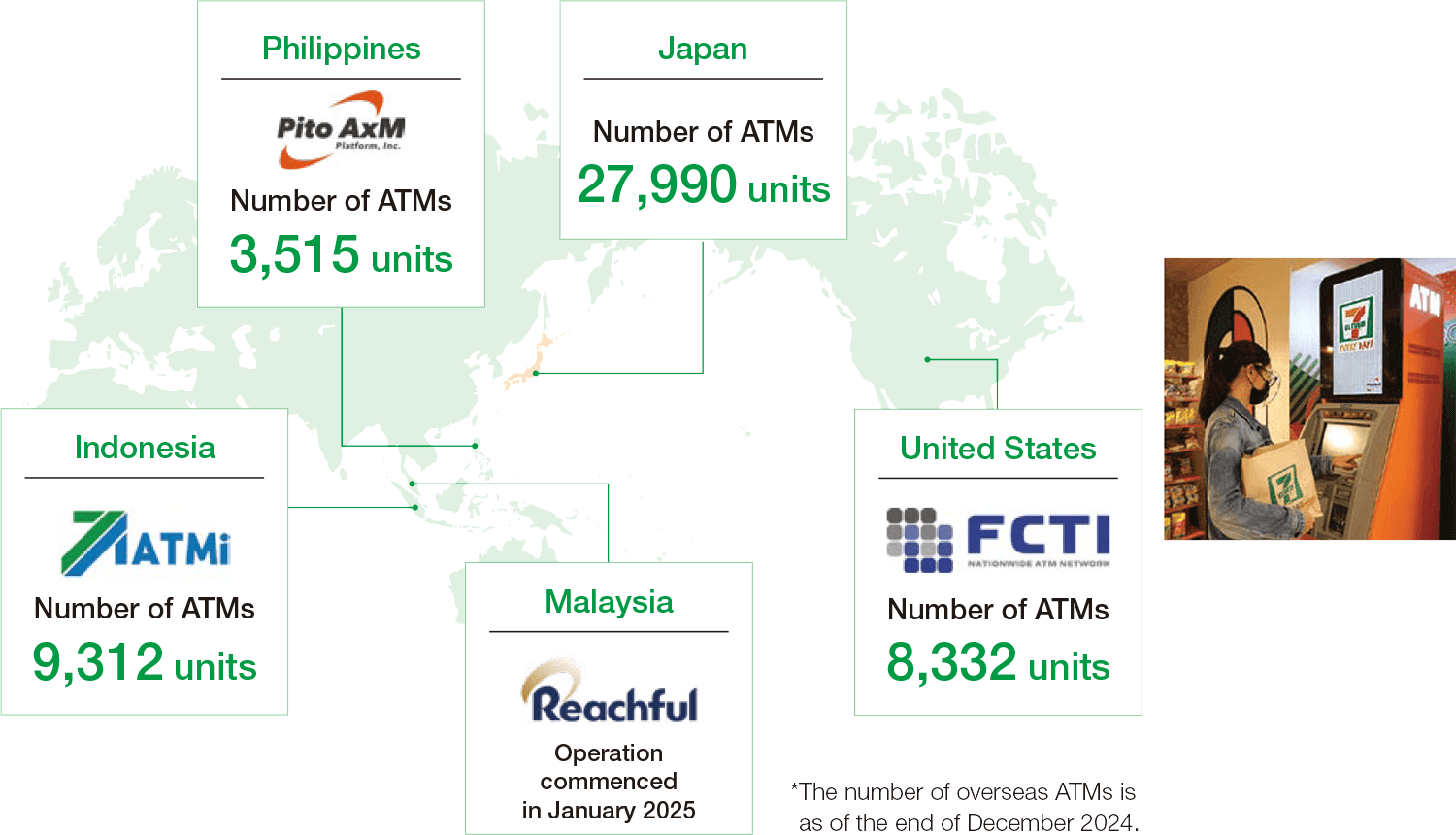

Realize UI/UX that combines safety and convenience

Pursue enhanced user experience

For Seven Bank, ATMs are our biggest touch point with customers. Satisfying customer needs promptly without bank staff, we pay close attention to every detail of the UI/UX to ensure a pleasant user experience. We are also constantly updating our account service smartphone app in response to customer requests and feedback.

Expand services to meet diverse needs

Evolution to service platform

We are developing and providing a broad range of services that revolutionize the traditional ATM concept, including cashless payment cash top-up, overseas card transactions that enable foreign tourists to withdraw Japanese yen, and performing counter services for financial institutions and other organizations Seven Bank’s share of ATMs in Japan overall has grown to over 15%. The number of transactions involving deposits and savings accounts and cards issued abroad also rose, bringing the number of ATM transactions in Japan to nearly 1.1 billion in FY2024.

Offering “Smartphone ATM transaction service” for cash deposits and withdrawals without using a card

Smartphone ATM services allow customers to deposit and withdraw money without a card, using only their smartphones, by using an app to scan a QR code displayed on the ATM. We are working to offer this service by further increasing our partner companies so that more companies, not only our existing partner companies, but also settlement service providers that do not issue cash cards and/or those who provide settlement through smartphones can make use of Seven Bank ATMs.

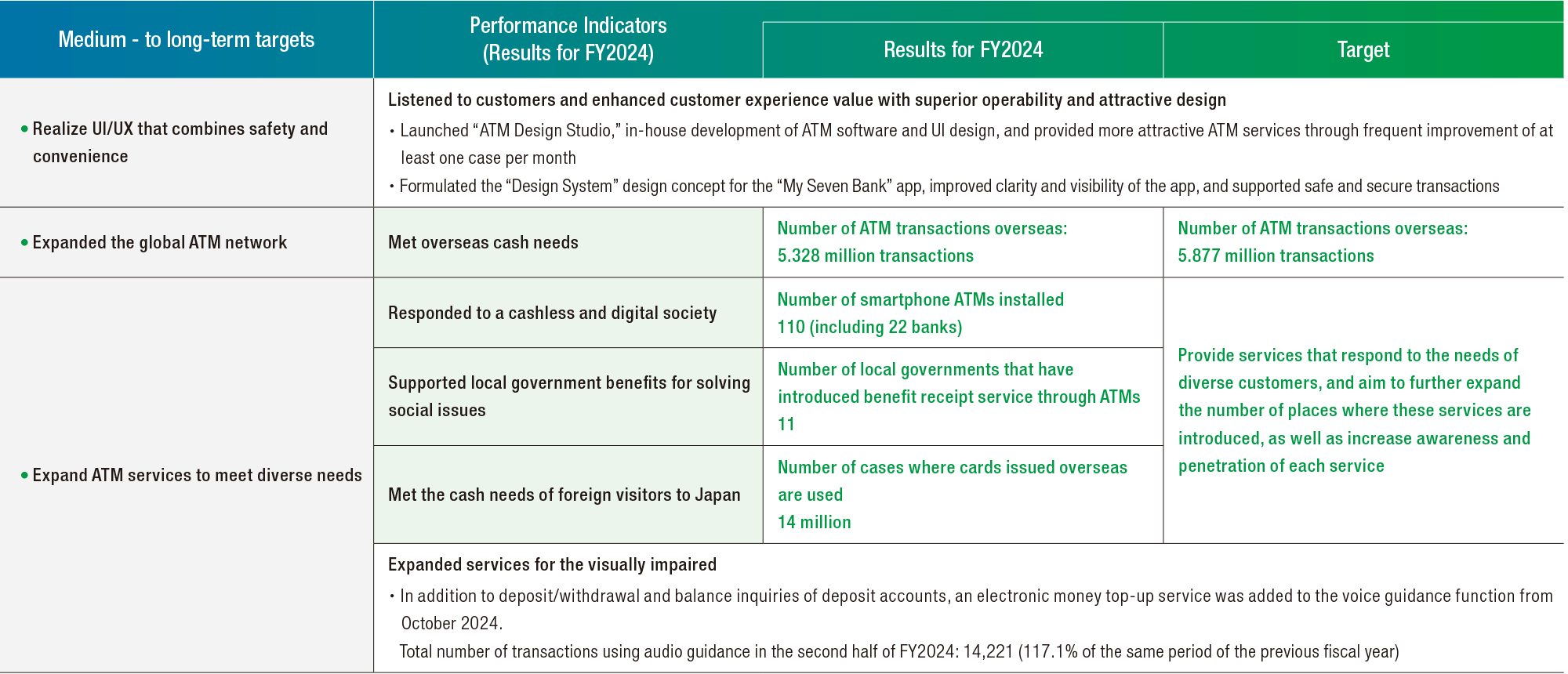

Number of companies using the ATM cash receiving service exceeded 1000

The ATM cash receiving service provided by subsidiary Seven Payment Service" ATM Receipt" has been used in a variety of situations, such as metropolitan railway companies and municipal services (including the receipt of grants and subsidies). The number of partner organizations was over 1,000 as of the end of FY2024. It has received high praise for its exceptional convenience, allowing cash to be received in principle 24 hours a day, 365 days a year, and reducing the burden of obtaining and managing account information, as well as remittance operations.

We will strive to further expand our business by offering unique services that make the most of the strengths of our ATMs located in many places convenient for customers, including the ATM cash collection service and the service for acceptance of cash proceeds from sales.

Voice Guidance Service to Assist Visually Impaired and Other Customers

Seven Bank ATMs offer a voice guidance service in support of visually impaired customers who find the ATM touch panel difficult to use.

By following the voice guidance and operating the buttons on the ATM intercom, customers can make withdrawals, deposits, balance inquiries and, at our newer ATMs, perform electronic money charging.

By following the voice guidance and operating the buttons on the ATM intercom, customers can make withdrawals, deposits, balance inquiries, and electronic money charging.

- *Over 500 of our partner financial institutions support the voice guidance service.

Service development starting with “My Seven Bank”

Starting with “My Seven Bank,” a smartphone app that allows customers to open an account in 10 minutes at the fastest, Seven Bank provides convenient and accessible financial service such as debit services and card loans. In addition, Seven Card Service Co., Ltd. issues and operates credit cards and “nanaco,” an electronic money service.

We aim to create unique financial service unique to the origins of the retail industry by integrating account services and payment services that closely accompany customers’ daily lives.

Expanded the global ATM network

Promoting the installation of ATMs in locations conveniently accessible in customers’ everyday lives

We have a network of approximately 50,000 ATMs in Japan and abroad With more than 1.6 billion total transactions, we have established a social infrastructure accessible anytime, anywhere.

We currently operate in four countries abroad. Starting in the U.S., we expanded to Indonesia and the Philippines. And we launched operations in Malaysia in January 2025. e operate in regions with strong cash needs and few ATMs in place, and are building an ATM network that can be easily used as a base for daily living.

- Seven Bank’s Sustainability

- Top Message

- Sustainability Management

- ESG

- Environment

- Social

- Corporate Governance

- Materiality

- Materiality top

- Fundamental value

Offer a social infrastructure available anytime with safety and security - Social value

Realize a wide variety of services accessible to anyone, anywhere - Creation of new values

Create unique values beyond our customers’ expectations - Source of value creation

Create a society where everyone can be active - Value creation for the future

Contribute to the prosperity of our society and the future of the Earth

- Social Contribution Activities

- For Future Generations

- Social Contribution Activities

- Other Corporate Information

- Investor Relations

- Company