TOP MESSAGE

We aim to achieve our Purpose through the continuous creation of value that is first in Japan and first in the world.

Even during a period of transition, we will maintain our unique presence.

President and Representative Director

Succession of new services that embody our Purpose

In fiscal 2024, we entered a phase in which the aspirations embodied in the Purpose we set forth in April 2021, “We shape the future of everyday life by seeing your wishes and going beyond,” would be delivered to customers one after another in the form of actual services.

The “+Connect” service introduced in September 2019 allows customers to perform all procedures and authentication using leverage of the high-performance fourth-generation ATMs. As part of this service, we have launched “FACE CASH” in February 2025, which makes it possible for users to conduct deposits and withdrawals using facial recognition, offering a new financial experience.

Moreover, an increasing number of municipalities are introducing ATM cash receiving service that allow customers to receive benefits, etc. in cash. We are creating a range of ATM-based services in support of customers and local communities.

Furthermore, in December 2024, we launched a service that facilitates the opening of bank accounts at ATMs by foreign nationals employed in Japan even if they have been in the country for less than six months, provided they satisfy specific conditions. We have also established a contact center where support is available in 10 languages—a rarity in Japan’s financial industry.

As Japan faces a declining domestic population, the number of foreign workers is expected to continue increasing in the coming years. We will continue to create services that contribute to fostering a society in which everyone can play an active role by providing an environment in Japan that is hospitable for living for people from abroad.

The world around us is changing at a frenetic pace. All industries are having to deal with the diversification of consumer needs and sales channels, as well as the soaring costs of raw materials and labor, and as a result must leverage digital transformation (DX) in pursuit of advanced, differentiated strategies. The financial industry is no exception. Over 40% of settlements are now cashless, and there is fierce competition for deposits in an interest-bearing world, as well as cross-industry alliances and mergers.

As a financial institution that originated in the retail industry, Seven Bank leverages its unique business model of operating convenience store ATMs to resolve a variety of social issues and create new value for our customers. We continue to take on the challenge of the timely creation of services that are first in the industry, in Japan, and in the world.

Consolidated ordinary income reaches all-time high, but challenges remain in terms of profits as we enter the final year of the Medium-Term Management Plan.

In fiscal 2024, ATM usage grew, and overseas operations also performed well. Furthermore, revenue from Seven Card Service, which Seven Bank made a consolidated subsidiary in July 2023, was recorded for the entire year, resulting in consolidated ordinary income surpassing 200 billion yen for the first time ever, reaching an all-time high of 214.4 billion yen.

Meanwhile, consolidated ordinary profit amounted to 30.2 billion yen, down approximately 10 billion yen from its peak. While we continued growth investments, costs took precedence in certain areas, and the overall situation for fiscal 2024 was difficult, particularly with regard to profit.

Fiscal 2025 is the final year of the current Medium-Term Management Plan. Our current business results forecasts for fiscal 2025 call for consolidated ordinary income of 216.0 billion yen and consolidated ordinary profit of 24.5 billion yen, falling short of the initial targets of 250.0 billion yen and 45.0 billion yen, respectively. With the aim of bridging the gap to the extent possible, in this fiscal 2025, we will focus on enhancing the profitability of our ATM business and elevating our core business to the next stage. At the same time, we will reinforce the business infrastructure of our overseas operations and retail business so they may become the next pillars of revenue. Over the next few years, we will diligently work to achieve our initial targets for both revenue and profit.

Moreover, on June 20th, 2025, Seven Bank acquired treasury stock with a total approximate value of 50.8 billion yen from three wholly-owned subsidiaries of Seven & i Holdings Co., Ltd.: Seven-Eleven Japan Co., Ltd., Ito-Yokado Co., Ltd., and York Benimaru Co., Ltd. As a result of this acquisition, the company is no longer a subsidiary of Seven & i Holdings Co., Ltd., having become an equity-method affiliate. We remain committed, however, to expanding our business while maintaining close collaboration, with a focus on ATM machines installed in 7-Eleven stores. On the other hand, we believe that the parent-subsidiary listing relationship being dissolved will facilitate our promotion of more flexible business strategies than ever before, as it will further enhance our management independence and neutrality. We will utilize the treasury stock acquired flexibly in line with future business environment changes and management strategies.

Seven Bank will continue to leverage its singular strengths and steadily advance its growth strategy centered on its Purpose to achieve sustainable growth and boost corporate value.

Heightening quality to lead the domestic ATM industry and pursuing expansion

Our mainstay domestic ATM business is evolving from a cash platform for cash deposits and withdrawals to “ATM+,” a service platform that is closely linked to the lives of customers. In March 2025, we completed the replacement and installation of approximately 28,000 fourth-generation ATMs across Japan, enabling the uniform nationwide rollout of the aforementioned +Connect service. The number of companies that have adopted the ATM Teller service, which allows customers to perform procedures traditionally accomplished at bank branch counters, and the ATM Notification service, which performs notification services in lieu of mail, has surpassed 20 and continues to grow, with convenience stores increasingly assuming the role traditionally served by bank branches.

Furthermore, the Smartphone ATM service, which makes cash deposits and withdrawals possible using only a smartphone, is used on a widespread basis, and people are increasingly using ATMs for convenience. Even amidst a decline in the total number of ATMs installed in Japan, we have grown our ATM market share to over 15% through continuous release of new functions tailored to our customers’ and business partners’ needs, and by installing even more ATMs. We will continue broadening our ATM network and striving to become the bank with the ATM of choice, thereby making our core domestic ATM business even more competitive.

Offering highly convenient financial services through ideas characteristic of a financial institution that originated in the retail industry

Fiscal 2024 was also a year in which we pursued synergies between the Seven Bank Group and 7-Eleven to reinforce our services and offer increasingly convenient shopping settlement. We have succeeded in seamlessly connecting Seven Bank accounts, the Seven Card Plus credit card, the nanaco electronic money card, and 7iD, the common membership platform used at 7-Eleven and other stores. Seven Card Plus membership acquisition measures have resulted in an increase in users in their 20s and 30s, higher average purchase amounts, and more frequent use at 7-Eleven stores. We have also launched initiatives to utilize 7iD purchase data in marketing and personal loan credit assessments, and we expect to reach 80 billion yen in personal card loan balances, which is our target in the end of fiscal 2025. We will continue developing services that leverage our retail x financial strengths.

Operating overseas ATM network including over 20,000 machines with the objective of further diversifying revenue

We are also making steady progress with one of our key growth strategies, the development of overseas markets. In advanced markets—the U.S., Indonesia, and the Philippines—as of the end of fiscal 2024, we surpassed 21,000 ATM machines in total and 500 million total transactions, successfully expanding our operational scale. Ordinary income from overseas operations totaled 43.5 billion yen, comprising about 20% of the Group’s consolidated ordinary income, which contributed to diversifying our business portfolio. Although advance investment has resulted in a delay in the realization of profit, we expect all three companies achieving full-year profitability in fiscal 2025. Starting with Malaysia, where we launched operations in January 2025, we will leverage the expertise we have accumulated in Japan to deliver services tailored to each region’s needs and further boost profitability.

Providing society with convenient, secure financial infrastructure

In the corporate business, ACSiON, Ltd. is expanding its market share with anti-phishing services for financial institutions. With regard to back office, Bank Business Factory Co., Ltd. (BBF) provides reliable services including the back-office support for financial institutions and Anti Money Laundering/Countering the Financing of Terrorism (AML/CFT) consulting. We will leverage the expertise we have acquired through our business to hone our security technologies and serve as a business partner that ensures safety and security in support of the financial industry.

Employees apply AI to the re-engineering of their own work.

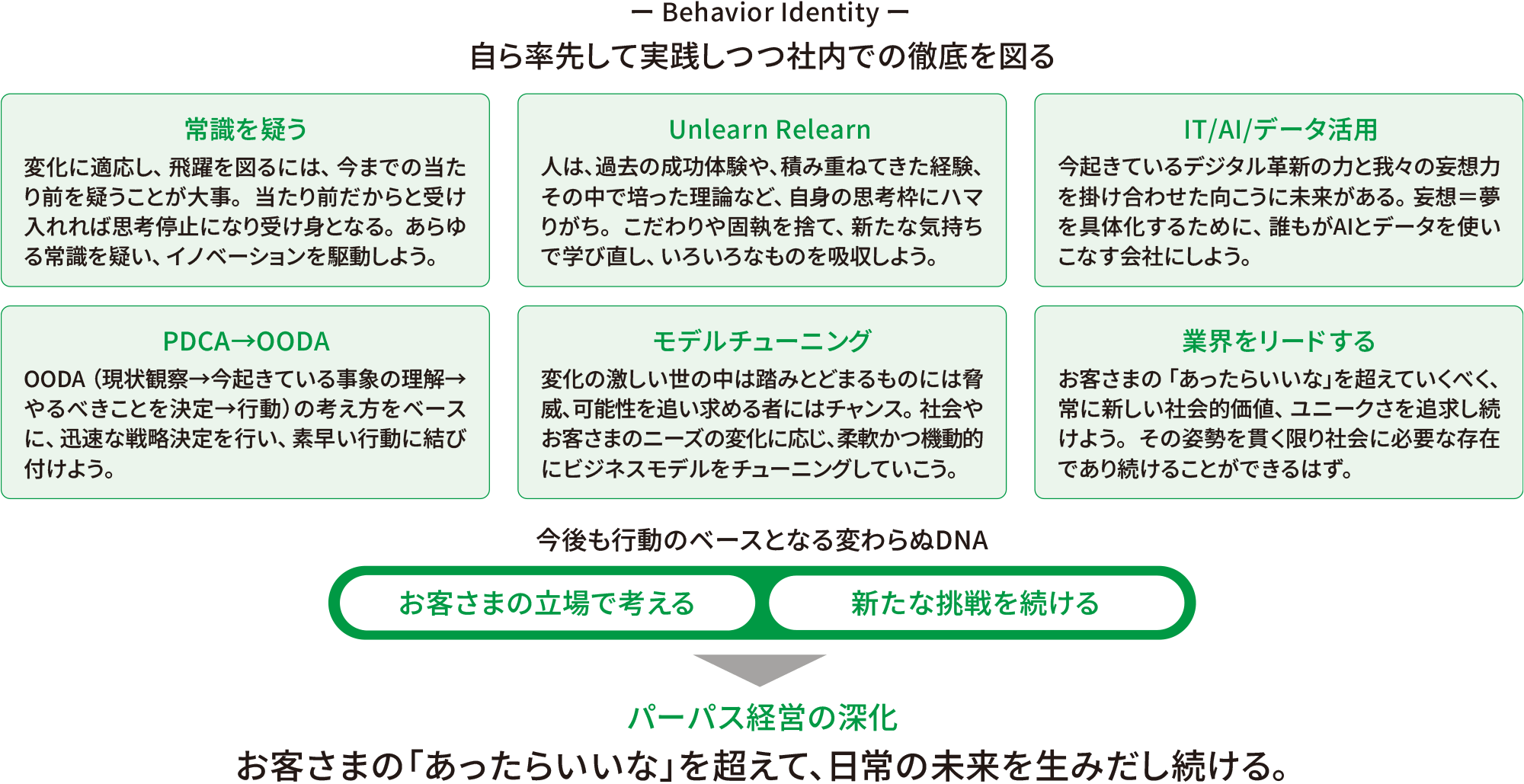

Culture in which people think independently and take on challenges

Our Purpose, “seeing your wishes and going beyond,” means creating as-yet unmanifested value for customers. Our ability to cultivate rich ideas, comprehend social issues, and transform them into business opportunities stems from us operating our business in convenience stores embedded in our lives.Achieving this requires nurturing an innovation mindset among self-directed individuals and fostering a culture where anyone feels empowered to take on challenges.

As part of these efforts, we are continuing our EX10 program, which allows employees to allocate 10% of performance evaluations to activities geared toward innovation. Under this system, the IT department as well as back office and corporate departments are developing their own no-code and low-code apps that can be easily developed even with limited knowledge of AI, data utilization, or programming, and applying them to the streamlining of daily operations. The role of employees is no longer to simply get the job done; rather, it is to re-engineer their work in line with changes in society. In this day and age, mastering digital technology—as well as the aforementioned—is a fundamental skill for members of society. Ideally, we will utilize AI to handle daily tasks to the extent possible, and thereby allow humans to focus on creative work AI is not capable of performing.

EX10 has resulted in the establishment of a culture in which people constantly take on new challenges. More employees are taking the initiative and running with ideas, instead of simply following the instructions of management. This has led to diversification and sophistication in our business. Employee growth drives company growth. I believe that we are on track to realize the ideal situation we have been striving for.

We are also fully committed to tackling sustainability head on and to contributing to solving social issues.

Sustainability initiatives as an integral part of our growth strategy

The vision of the Seven Bank Group is to constantly provide our customers with new conveniences and to continue growing our business. As a company with highly skilled small force, we leverage IT to maximize streamlining and efficiency with the objective of increasing profits. Furthermore, we consider it important to keep challenging ourselves to retain our uniqueness and to generate value that is first in Japan and in the world. In addition, In addition, mid-career hires comprise 80% of our company’s workforce, and our talent pool is diverse.mid-career hires comprise 80% of our company’s workforce, and our talent pool is diverse. Establishing an environment where DEI thrives and a corporate culture that encourages new challenges serves as a driving force for innovation.

In addition to the expansion of our business, we also proactively promote sustainability in line with our growth strategy as part of our social responsibility as a corporation. The company has engaged in reduction of ATM power consumption as one of the key development themes. We have successfully achieved a 40% increase in energy efficiency with the fourth-generation ATMs compared with their predecessors, which has reduced the impact on the environment during production and recycling. Going forward, we will proceed in collaborative initiatives with partner companies in security as well as maintenance and inspection. In addition to considering operations that will mitigate the environmental burden, including reviewing maintenance and inspection cycles and standardizing infrastructure and logistics, we are considering with those companies collaborative structures that enable us to leverage each company’s strengths and, through our core businesses, resolve a wider range of social issues.

Speaking at the 9th Sustainable Brands International Conference 2025

in Marunouchi, Tokyo, with business partners

To our stakeholders

At morning assemblies and other occasions, we always convey to our employees to “adapt to social change and strive to become a company valued by its customers.” We want to instill in them the awareness that their challenges as individuals not only leads to their growth and that of the company, but also to the capability of the nation of Japan to innovate. Our commitment is to leverage our strengths and singular characteristics in the provision of services that support daily life for local communities and customers. For customers such as financial institutions, we aim to be a co-creation partner that cooperates with these customers in considering the future. With boundaries between industries disappearing and significant transformations underway, our survival hinges on co-creating with partner companies that share our vision for the future and generating discontinuous value.

Since the company was founded, we have endeavored to ascertain customer and industry needs toward providing services. We will continue to drive our business forward toward realizing our Purpose and remain a presence in the creation of tomorrow’s daily life.

I’d like to close with a message to our investors. While we have not yet been able to fully satisfy your expectations with regard to corporate performance, we are definitely beginning to change. When we look back, we recall that it took a great deal of time and effort to truly establish convenience store ATMs. And today, we are tackling the major challenge of transforming the value of ATMs themselves. We will clearly show the path that will inevitably lead to new growth, while achieving sustainable growth and returns for the Group. I would like to express my gratitude in advance for your continued support.

- Management information

- Message from the President

- Management Policy, Management Environment, and Issues to be Addressed,etc.

- Risk Factors

- Risk Management Initiatives

- Compliance Initiatives

- Medium-Term Management Plan FY21-FY25

- Stock and bond information

- Stock Information

- Dividends and Shareholders Returns Policy

- Corporate Bond and Rating Information

- General Meeting of Shareholders

- IR Library

- IR News

- Financial Statements

- IR Presentations

- IR Calendar

- Annual report

- Seven Bank Disclosure Policy

- Other Corporate Information

- Company

- Sustainability