Seven Bank Group Integrated Report 2025 Message from the Officer in charge of Financial Strategy

Based on a sound financial foundation, we will enhance profitability and growth, with the aim of increasing medium- to long-term corporate value.

Ken Shimizu

Managing Executive Officer

in charge of Planning Division,

Brand Communication Division, and SDGs Promotion

Achieved record income, but both consolidated and non-consolidated profits declined due to impact of advance investment in growth areas

In FY2024, consolidated and non-consolidated income both rose, while profits fell. Consolidated ordinary income exceeded 200.0 billion yen for the first time, increasing 8.3% year over year to a record 214.4 billion yen. This was driven by several factors, including Seven Bank’s non-consolidated performance remaining strong, with its core domestic ATM business recording a year-on-year increase of 50 million in the number of ATM transactions to 1,089 million; income from overseas rising across the board; and income from Seven Card Service being recognized throughout the fiscal year (in FY2023, only the nine months following the acquisition were recorded due to the acquisition taking place partway through the fiscal year).

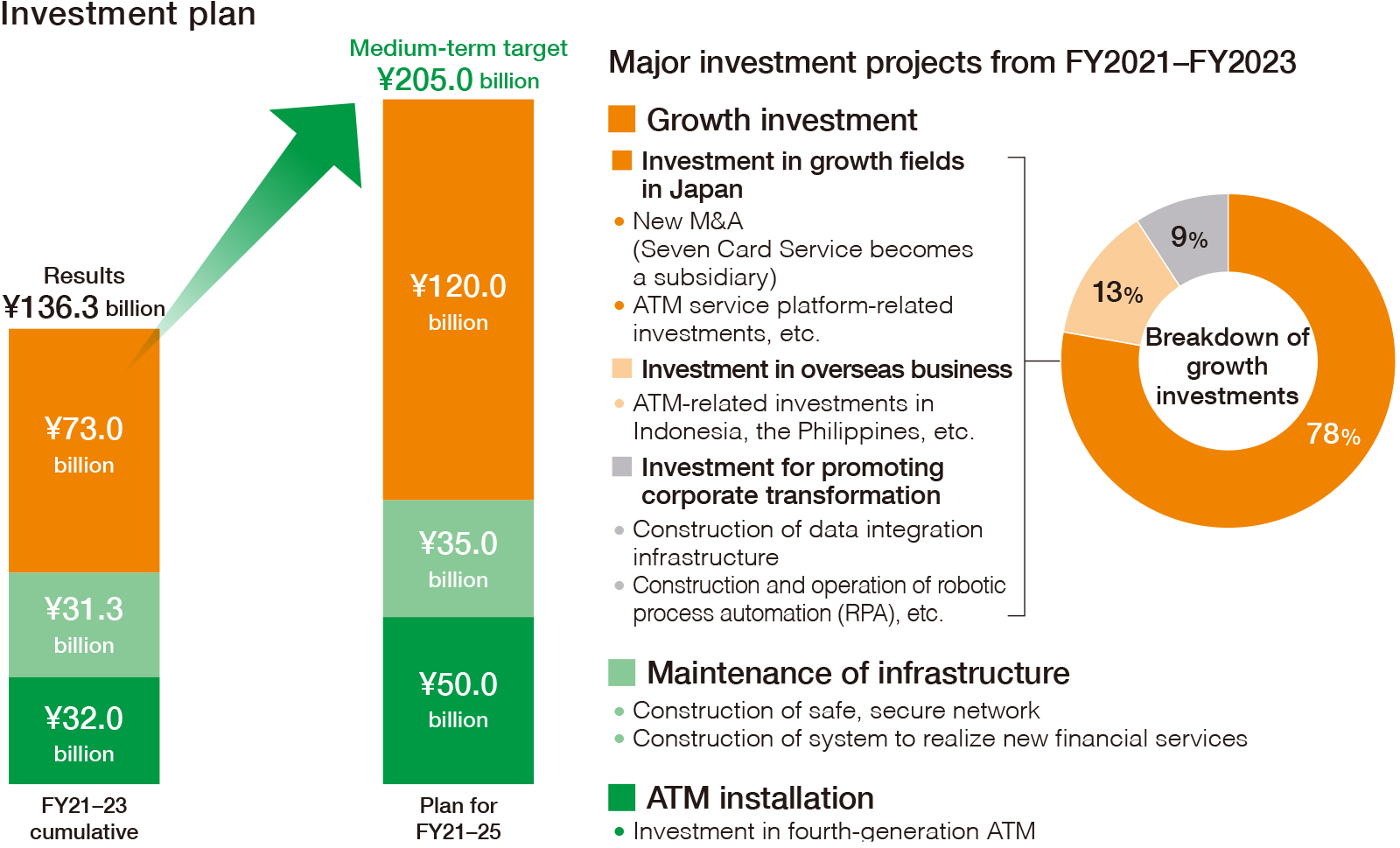

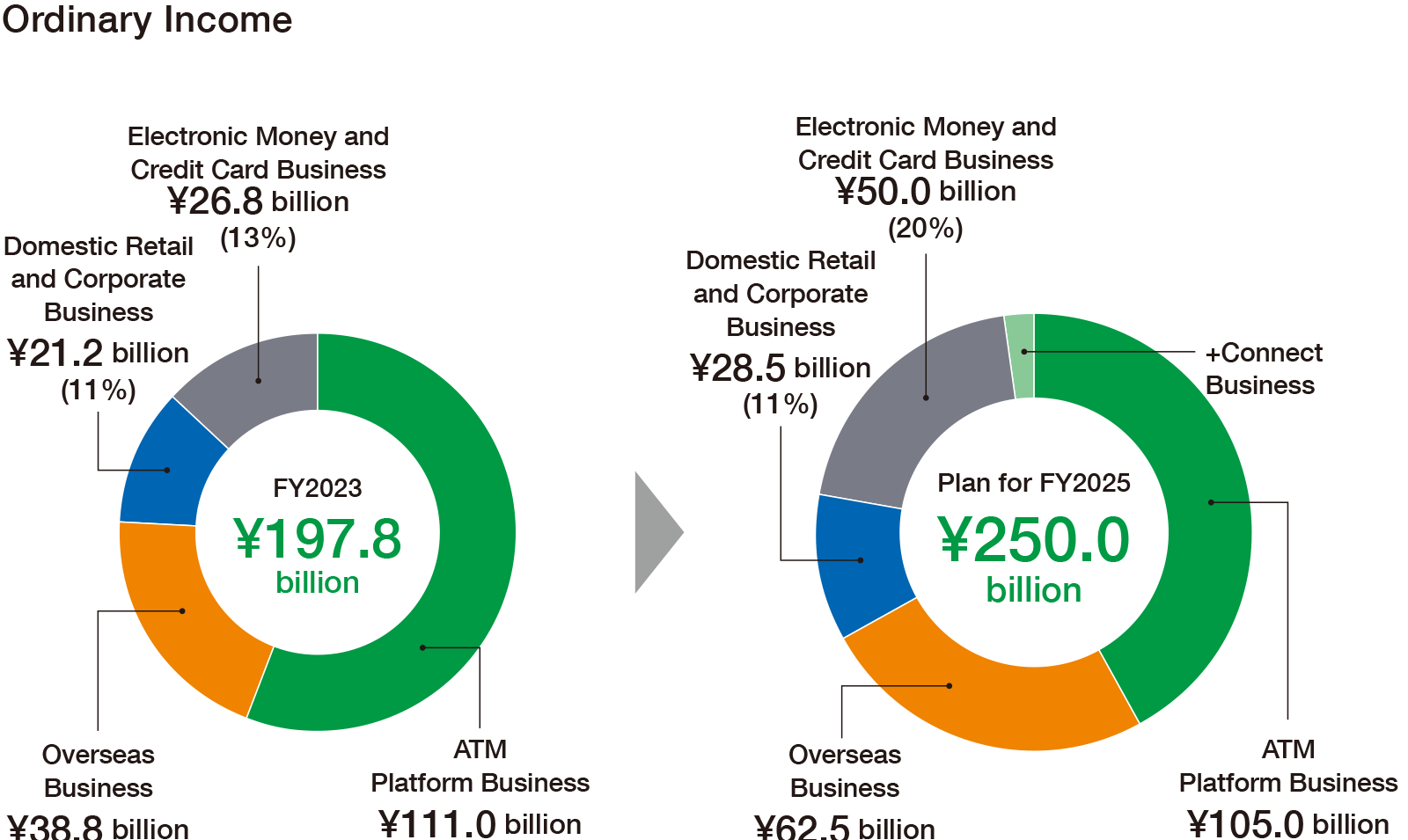

As a result, the consolidated ordinary income compound annual growth rate (CAGR) for the five years from FY2020 to FY2024 was 11.8%. In addition to recording record income and achieving high growth rates, we believe that our portfolio diversification over the past few years has made it possible for us to secure a reasonable level of earnings—not only in our domestic ATM business, but in multiple other businesses, which we regard as a major achievement. Meanwhile, consolidated ordinary profit amounted to 30.2 billion yen and consolidated net income was 18.2 billion yen, both declining year on year. This was attributable to expenses increasing, mainly due to an increase in depreciation associated with growth investments such as the introduction of fourth-generation ATMs and the +Connect services.

Significant deviation from Medium-Term Management Plan targets

Target figures can be achieved within a few years, however.

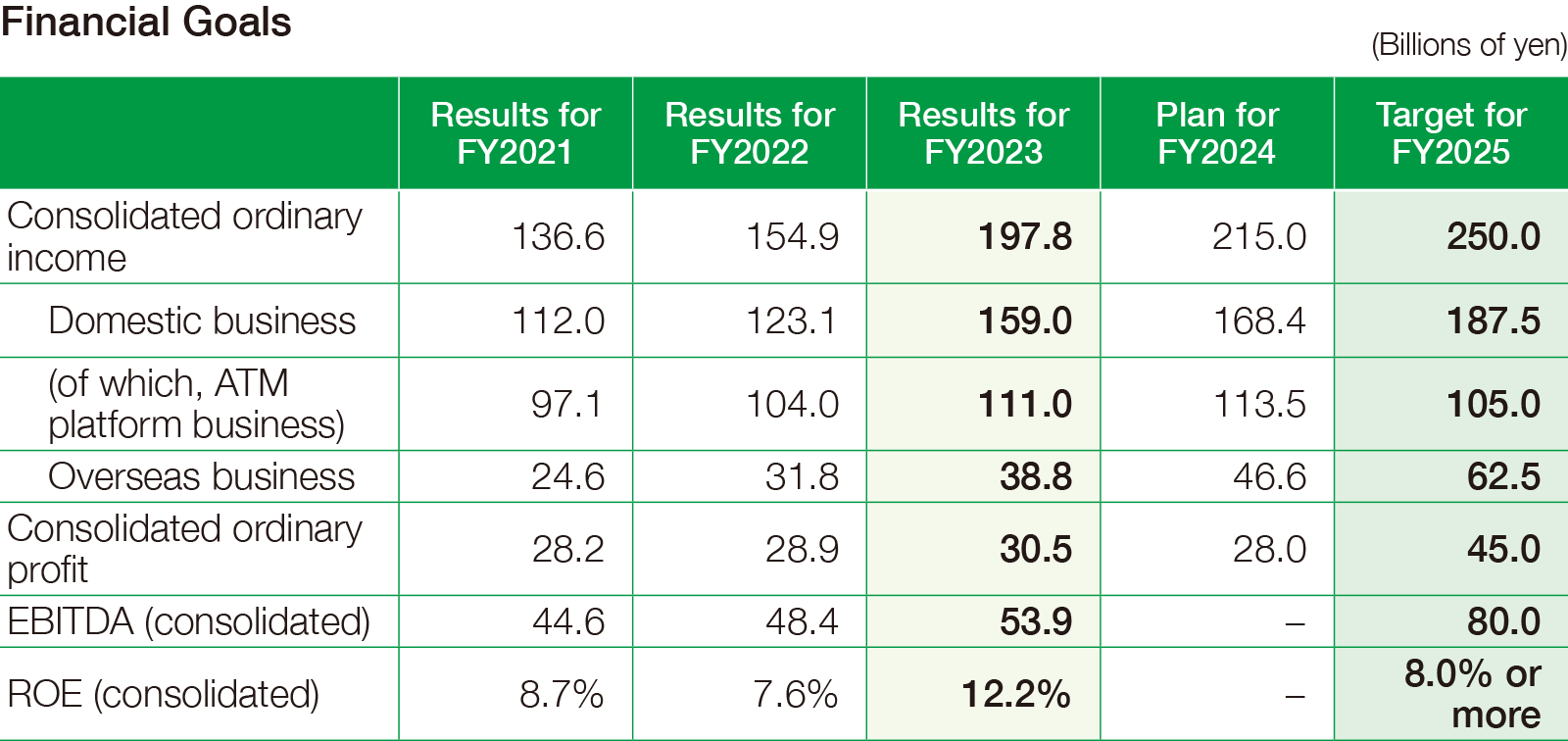

The final year of the Medium-Term Management Plan, in which we established targets of consolidated ordinary income of 250.0 billion yen, consolidated ordinary profit of 45.0 billion yen, and ROE of 8% or more, is 2025. However, the publicly announced plan for FY2025 calls for consolidated ordinary income of 216.0 billion yen and consolidated ordinary profit of 24.5 billion yen, both deviations from the previously stated targets. Looking at it in more detail, while we anticipate surpassing targets on a non-consolidated basis, the main reason is significant deviations from the targets in the plans of overseas group companies and Seven Card Service. Looking at overseas group companies, however, the U.S. has been profitable since the summer of 2024, and we have continued to see increased income and profits from Asia. With regard to Seven Card Service, we believe that strategic investment over the past few years to boost credit card membership will bear fruit. Therefore, even if we cannot achieve the targets set in the Medium-Term Management Plan by FY2025, we believe that we will do so within a few years.

Issues with profitability and growth potential

Raising these will enable us to achieve sustainable growth in corporate value.

As Chief Financial Officer, my role is to expand business overall while balancing stability, profitability, and growth, and providing appropriate returns to our shareholders.

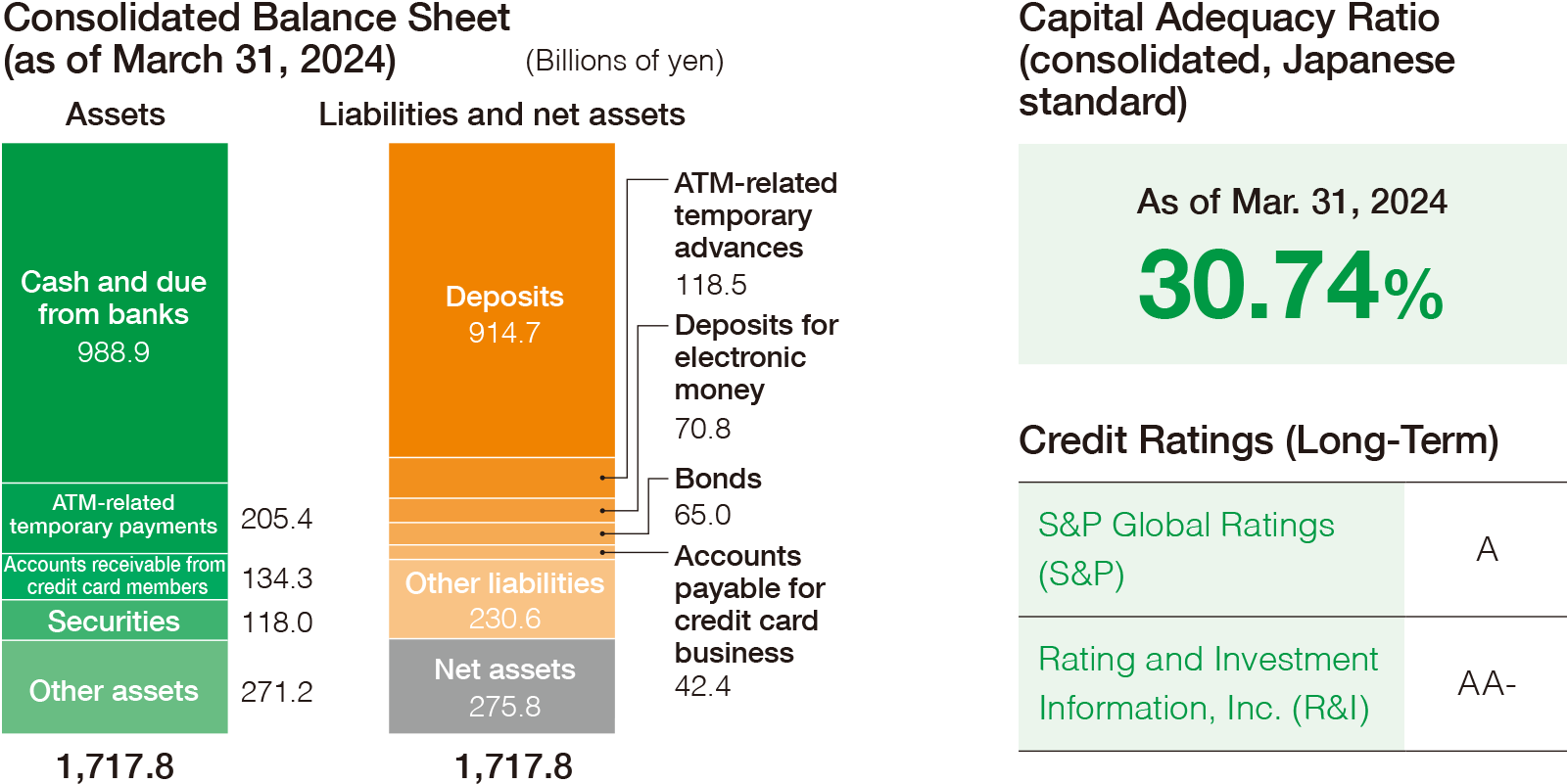

In June 2025, the Bank acquired approximately 50.8 billion yen of treasury stock, and is no longer a consolidated subsidiary of Seven & i Holdings Co., Ltd. Even after acquiring the treasury stock, our capital adequacy ratio remains high at over 20%. Moreover, although some external credit ratings have been revised, they remain high as well. There are some who say that our capital adequacy ratio is too high, but we believe that the present level is appropriate. In addition to our role as a financial institution, we are an infrastructure provider who is also responsible for operating a nationwide ATM network safely and reliably at all times. And, while securing capital to match risk assets and realizing M&A and other future growth strategies flexibly, we must also secure capital in preparation for various risks as an infrastructure provider. We will continue to maintain an appropriate level of capital while providing our shareholders with stable dividends, thereby ensuring steady returns on profits. As demonstrated by our solid financial foundation backed by a high capital adequacy ratio, at this point we have no concerns regarding stability. It is worth noting that, as our business overall is centered on the ATM platform business, some may be concerned in a rising interest rate environment about the financial impact of increased costs, primarily those related to cash procurement. In this regard, however, we are working on controlling cash in ATMs based on multiple scenarios, and we believe that the financial impact of rising interest rates will be limited.

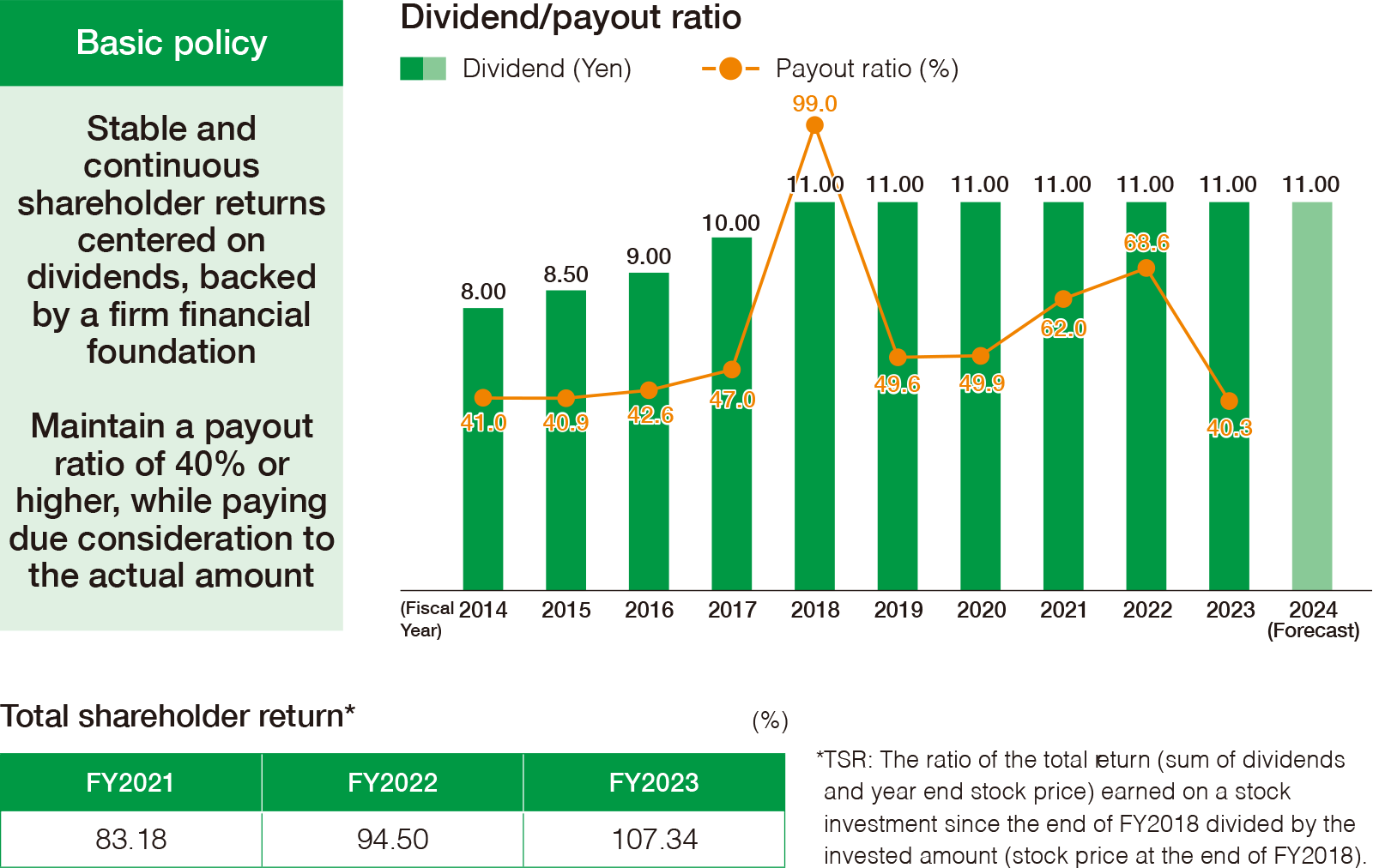

Meanwhile, there are issues concerning profitability and growth potential. Profitability is the ability to earn, and is simply expressed as profit margin or ROE. In recent years, both of these have been trending downward, and we recognize that a recovery is urgently needed. Growth potential refers to the prospects for future growth, and the objective is to achieve growth in income and earnings per share (EPS). Although both consolidated and non-consolidated income have continued to grow steadily over the past few years, EPS has been on the decline. Over the past five years, continuous stable dividends have resulted in the total shareholder return (TSR) exceeding 100%. We believe, however, that we can raise it further by improving profitability and growth potential, thereby elevating the share price.

Restoring ROE to 8% is top priority

We will work to swiftly improve net profit margin, financial leverage, and total asset turnover ratio.

The top priority is to restore ROE to 8%. In FY2024, ROE was 6.6%. Meanwhile, the cost of equity based on the capital asset pricing model (CAPM) is acknowledged to be in the mid- 5% range. Currently, we are achieving ROE that surpasses the cost of equity. The difference between ROE and cost of equity (equity spread) and the PBR (price book-value ratio, 1.18 times as of FY2024) and stock prices, however, are linked in terms of trends to a certain extent. Therefore, we believe it is vital to fortify financial and non-financial information disclosure, enhance engagement with shareholders and investors to reduce the cost of equity, and simultaneously boost ROE to expand the equity spread, thereby contributing to improvements in PBR and stock prices.

To improve ROE, we will work to improve our net profit margin by strengthening high-margin business (domestic ATM business) and streamlining operations to optimize expenses, improve our financial leverage by expanding risk assets (personal loans, etc.), and improve our total asset turnover ratio by reducing low-profit assets (excessive cash in ATMs, etc.). While we cannot improve ROE overnight, we will promptly implement the aforementioned measures.

The fact that our shares can be purchased for a relatively small amount and generate a relatively high yield has resulted in high evaluations from many investors and shareholders. Meanwhile, we are aware that people are dissatisfied with the drop in profit margins and ROE, as well as the sluggish growth in TSR reflecting these factors. If, however, we do not continue to actively invest in growth and drive service enhancement forward in a way that anticipates customer needs, it could result in driving customers away. This trend is evidenced by the decline in traditional ATMs dedicated to cash deposits and withdrawals, which reflects the transition toward cashless payments and changes in lifestyles. With settlement and identity verification functions, our multifunctional ATMs are certain to become an increasingly important part of social infrastructure. While aggressively investing to further refine our ATM business and diversify our portfolio, it will be difficult to boost profit margins and ROE, but we will face this challenge directly.

We will continue carefully explaining these strategies to our shareholders and investors and attempt to secure their understanding, and build relationships based on trust. We would appreciate your continued support and evaluation for many years to come.

- Management information

- Message from the President

- Management Policy, Management Environment, and Issues to be Addressed,etc.

- Risk Factors

- Risk Management Initiatives

- Compliance Initiatives

- Medium-Term Management Plan FY21-FY25

- Stock and bond information

- Stock Information

- Dividends and Shareholders Returns Policy

- Corporate Bond and Rating Information

- General Meeting of Shareholders

- IR Library

- IR News

- Financial Statements

- IR Presentations

- IR Calendar

- Annual report

- Seven Bank Disclosure Policy

- Other Corporate Information

- Company

- Sustainability