Individual InvestorsWe shape the future of everyday life by seeing your wishes and going beyond

Seven Bank’s Operating System

Seven Bank provides a unique financial service that is close, convenient, reliable, and safe. Our domestic network of 28,000 ATMs can be found at Seven & i Group stores, including 7-Eleven, as well as shopping centers, tourist destinations, airports, and stations, to meet the diverse needs of our many customers. We make use of DX to provide unique financial services. For individual customers, we offer convenient account services that support their daily lives. For corporate customers, we offer secure and convenient services that take advantage of Seven Bank’s strengths, including ATMs. At the same time, we are leveraging our ATM operating know-how to expand ATM services in the United States, Indonesia, the Philippines, and Malaysia.

Domestic business

ATM platform strategy

Retail strategy

Corporate strategy

- Consolidated subsidiaries

- Bank Business Factory Co., Ltd

- Seven Payment Services, Ltd.

- ACSiON, Ltd

- VIVA VIDA MEDICAL LIFE CO., LTD

- Seven Card Service Co., Ltd.

Overseas business

Global strategy

- Consolidated subsidiaries

- FCTI, Inc.

- PT. ABADI TAMBAH MULIA INTERNASIONAL

- Pito AxM Platform, Inc

- Reachful Malaysia Sdn. Bhd.

Unique Business Model

Seven Bank operates more than 28,000 ATMs in all 47 prefectures of Japan, providing services that meet our customers’ diverse needs. Our ATMs continue to expand into train stations, commercial facilities, and ATMs jointly operated with financial institutions, accounting for 15% or more of Japan’s total ATM market share. We will continue evolving and expanding as a vital cash platform in Japan.

In March 2025, we completed the replacement of all ATMs with fourth-generation ATMs. Customers can now take full advantage of a broad range of features such as facial recognition. We will actively expand our “+Connect” service, including opening accounts, changing addresses, and registering for direct banking, to offer services that exceed the wishes of our customers.

Business model (examples of ATM transactions and +Connect)

Coexistence and co-prosperity partners

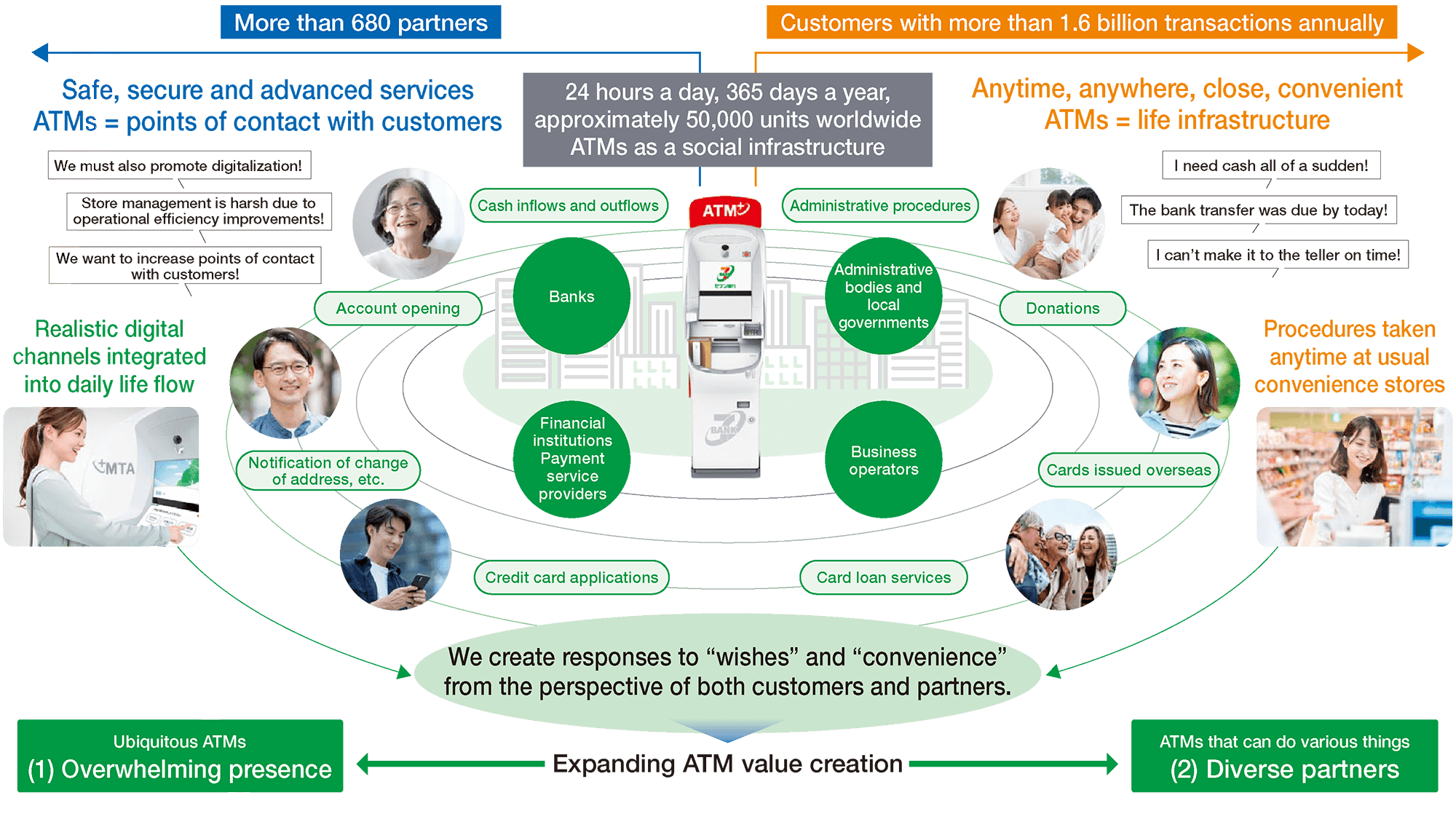

Our core business is to provide customers and affiliated financial institutions with convenient and benefits through Seven Bank ATMs.

We will strive to form partnerships with all financial institutions so that customers can use any of their cards.

| Banks | 121 |

|---|---|

| Shinkin banks | 253 |

| Credit cooperatives | 122 |

| Labor banks | 13 |

| JA Bank | 1 |

| JF Marine Bank | 1 |

| Shoko Chukin Bank | 1 |

| Securities companies | 8 |

| Life insurance companies | 2 |

| Other financial institutions | 160 |

| Over | 682 |

※JA Bank and JF Marine Bank are each counted as 1 institution.

Enhancing the Corporate Value

Competitive Advantage of Seven Bank Group

The Bank’s strength is its ATM platform business, which is unparalleled in the world. Since its foundation, the Bank has devoted all its resources to refining the platform business. The Bank has grown as a social infrastructure that can respond to diverse needs by closely following the needs of each customer and each business partner, accumulating improvements and refinements, and continuing to develop unique services. Currently, the Bank has an ATM network of approximately 50,000 units worldwide, and provides services to society through more than 680 partners, with the number of transactions exceeding 1.6 billion annually. We will continue to use this network to identify new needs and further expand the potential of ATMs.

Expansion of the ATM network

In Japan, we completed the replacement and installation of all fourth-generation ATMs in FY2024. In addition to cash inflows and outflows, the platform can be used by anyone anywhere in the country as a multifunctional service platform equipped with identity verification and face recognition functions. Furthermore, overseas, we operate in regions with strong cash needs and few ATMs in place, and are building an ATM network that can be easily used as a base for daily living.

Value Creation of Seven Bank Group

Growth Strategy

Summary of Medium-Term Management Plan (FY2021–FY2025) and Future Development

Progress of Medium-Term Management Plan

Numerical Results

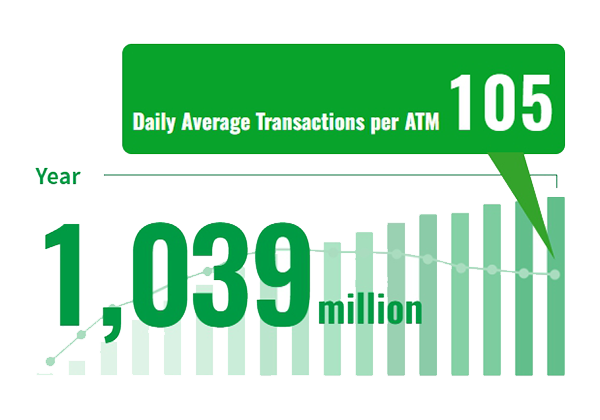

Although both earnings and profit are expected to fall short of the Medium-Term Management Plan targets, earnings have steadily increased.

Business portfolio reforms have steadily progressed, and we will continue to promote business strategies with a sense of speed.

Major initiatives in FY2025

Seven Bank in terms of numbers

Number of ATM transactions per Fiscal Year

The operational rate of our ATMs