IT Strategy

Creating the “future of everyday life” through original services utilizing IT

(Left)

Yoichi Mizumura

Executive Officer in charge of ATM Solution Division

and ATM Operations Management Division

(Right)

Taku Takizawa

Executive Officer in charge of Financial Solution Division

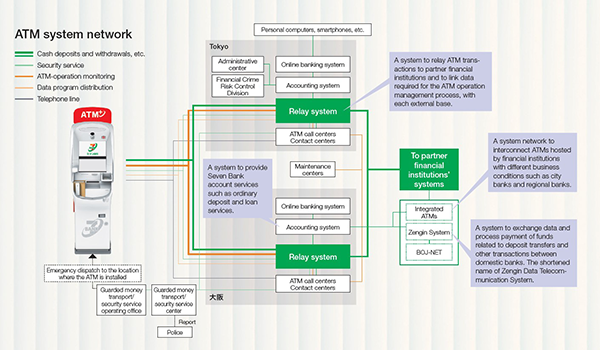

Mizumura: Since we launched our ATM service, using our proprietary system, we have developed them with a focus on safety, security, and convenience. The key is achieving “uninterrupted, stable operation.” This is a daunting task, given that we have approximately 28,000 ATMs nationwide. By building a unique system centered on ATMs, however, we can deliver advanced, stable operations even without staff members.

On a daily basis, for instance, we collect data on ATM component operation at a central center and analyze it in detail to predict malfunctions. We prevent cash shortages using AI technology. We respond promptly to customers by collaborating with call centers and maintenance and security systems.

The reason why we can stably process more than 1.0 billion online transactions each year is because Seven Bank ATMs serve as a service platform for our customers, while also playing the role of a back-end platform in support of transactions for over 670 partners.

Takizawa: The account system I am responsible for differs from our proprietary ATM development in that our approach is to maximize the use of existing systems and general technologies. Duplication is the most important concept in ensuring the stable operation of an account system. The core systems of banks (core systems) are always duplicated so that in the event one system stops, the other continues operating. Generally, depending on system characteristics, they are configured as either “active-active,” where both systems are always running, or “active-standby,” where one system is on standby. In our case, however, we adopt the former system, which allows for immediate switching whenever possible.

Furthermore, in preparation for any type of disaster, we have established disaster recovery (DR) sites at remote locations in Tokyo and Osaka for our accounting and other core systems. And, in 2018, we introduced the “Tokyo-Osaka Alternating Operation System,” the first of its kind among Japanese financial institutions, where two systems are operated alternately as the primary. We take pride in the fact that this initiative is rare in the banking industry. Regularly switching the primary system has enabled the advancement of Business Continuity Plan (BCP) and 24/365 uninterrupted operation.

Toward zero system outages

The pursuit of anticipation and mobility

Mizumura: It is essential to respond quickly to rapid changes in society and technology for ATM systems to keep operating stably. We are strongly conscious of anticipation because we develop completely original ATMs. This is the idea of incorporating changes that may occur later into the design stage. For example, we handled the new banknotes introduced in 2024 simply by updating the software. Our advance incorporation of the necessary mechanisms into the design made this possible. Anticipating future needs and incorporating them into the design allows us to respond flexibly to changes in the world without the need for major renovations that would stop system operation. We have already achieved designs that facilitate addition of new authentication methods, including iris and fingerprint recognition.

Takizawa: The account system focuses on quick response to changes in the world and providing services swiftly by maximizing the use of existing systems and general technologies. Examples of our advanced initiatives include our early adoption of cloud technology and the development of core systems such as internet banking and ATM relay systems.

In recent years, we have conducted agile development of new services while being particularly mindful of “small starts.” This is a development style in which we make the service small to begin with, and then improve it while monitoring customer reactions. The results of development using this approach include the smartphone app My Seven Bank, the ATM cash collection service that allows users to deposit sales proceeds at Seven Bank ATMs, and the recently redesigned “Tsutsumuto” service, which lets users send gifts from ATMs smartly, easily, and conveniently. The “small start” approach not only facilitates quick and low-cost launch, but offers the significant advantage of enabling developers to flexibly change direction based on feedback from customers.

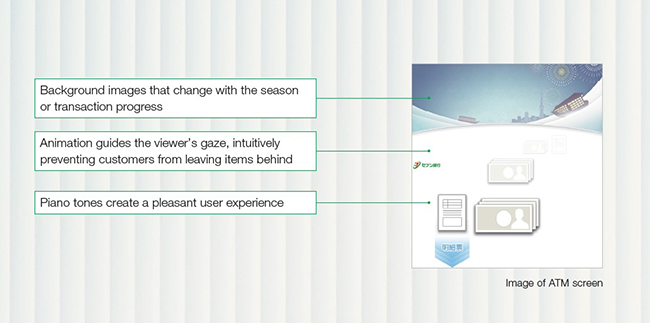

Mizumura: As ATMs are the most familiar presence for our customers, we are thoroughly committed to the user experience (UX). We pursued ease of use with a large dual-screen display, employed animation and sound to guide customers intuitively, and created seasonal screen displays, which elicited reactions on social media such as “Santa Claus has appeared!” We have tested in detail to determine how customers feel about minor details such as the feel of the keys and the sound they make when pressed and have implemented improvements based on our findings.

In-house development and design

Building an organization that fosters creativity

Takizawa: I believe that this originality is the result of our organizational and development systems. With regard to our account system, we have actively engaged in in-house development in recent years. Of course, we do not solely handle all of the development; rather, we receive cooperation from many partner companies. We feel, however, that maintaining development resources in-house is particularly advantageous in the early planning stages and in situations where improvements have to be implemented quickly.

When outsourcing development, it can take time to even get through the approval process and contract procedures. With in-house development, though, as soon as you decide to attempt something new, you can immediately create a prototype and verify it. We are not a company specializing in system development; rather, we are a business company that offers financial services. That is why we are constantly exploring how we can fully leverage IT to contribute to business, and what our customers truly value.

Mizumura: In the ATM Business, we launched a specialized team called ATM Design Studio in 2023, and began developing ATM software and designing user interfaces (UI) internally, which is extremely unusual among Japanese financial institutions. Led by our in-house development team and designers, we design and develop ATM transaction screens and other systems internally.

The advantage of in-house development is the ability to respond to customer feedback more directly and quickly. As an example, ATM Design Studio and call centers collaborate to analyze customer issues reported to the centers each day and to feedback posted via social media. By identifying specific issues such as “this display is unclear” or “many users give up the process at this step,” designers and developers can now put far more improvements into practice in a shorter period of time, greatly improving the speed of improvement. Going forward, this team will also be responsible for developing new services.

Takizawa: It’s actually unusual for a bank to have in-house designers. The design for our smartphone app, My Seven Bank, was also created in-house. For this project, we formulated a design system that integrated the design concept and policy. Improvements in design clarity and visibility may seem minor in terms of effects. We believe, however, they contribute greatly to peace of mind and convenience for customers.

Future IT strategy

that goes beyond “seeing your wishes”

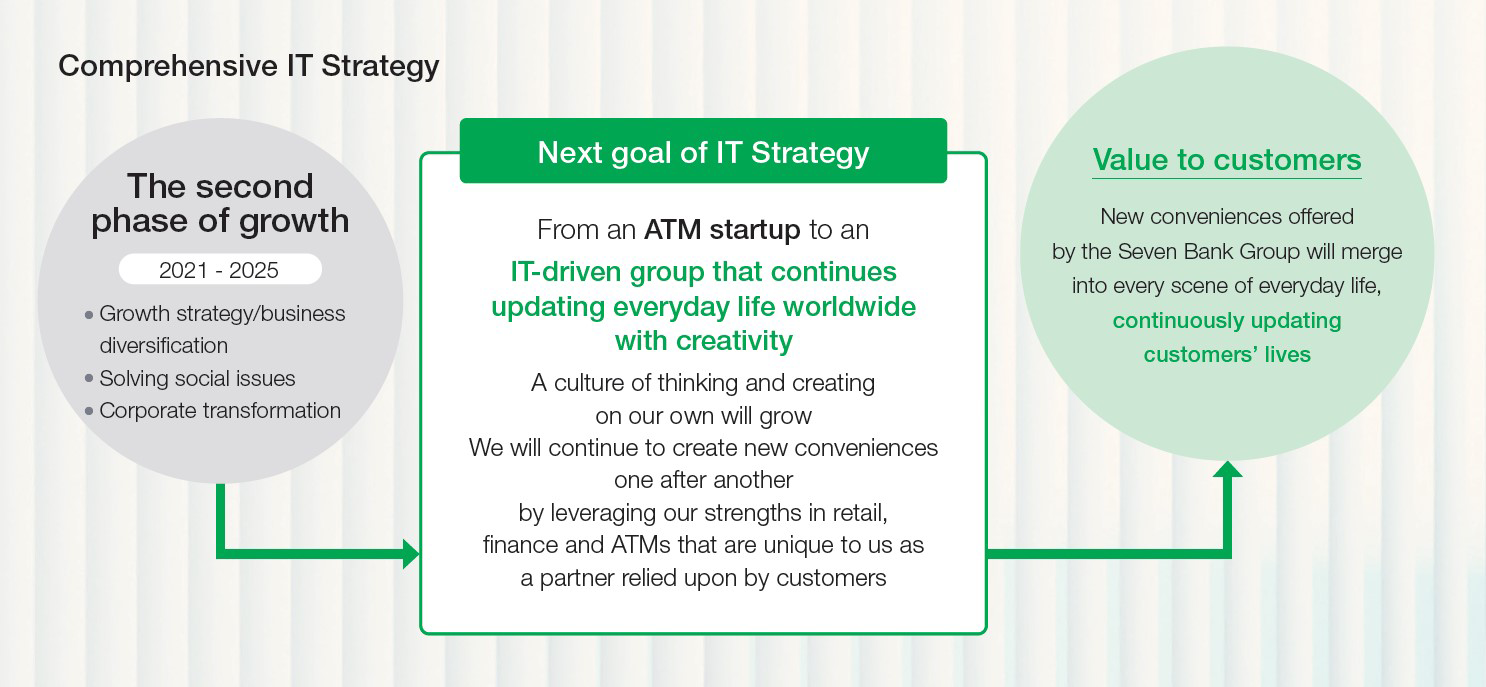

Mizumura: Our aim is to create a future in which the new services we offer are naturally integrated into our customers' daily lives, improving their quality of life and giving them convenience and fulfillment in an essentially unnoticeable way. Toward realizing this, our development team has established a grand vision: “From an ATM startup to an IT-driven group that continues updating everyday life worldwide with creativity.” Achieving this will require us to foster a companywide “culture of thinking and creating on our own.”

Takizawa: Mr. Mizumura’s comments relate to the importance of revamping overall design in our IT strategy and upgrading and expanding human resources. In that same vein, we will continue pursuing technologies that accurately grasp customer needs and enable us to satisfy those needs with our account system. We believe, for instance, that technologies such as generative AI and AI agents, which recently have become very much in vogue, can potentially simplify procedures for our customers. It is important to remember, however, that there are many tools available, and that IT is only one of them. Instead of focusing on technology, we accurately identify what our customers truly desire and select and utilize the most appropriate technology to deliver it. We will always be mindful of this balance and strive to leverage the power of IT to create a new normal that surpasses customers’ expectations.

Mizumura: As discussions progress on fifth-generation ATMs, it is not simply the pursuit of technological innovation. We develop concepts from a more philosophical perspective, giving thought to what customers will want from brick-and-mortar stores and physical channels, and how our ATMs can offer value in that context. Given this, through industry-academia collaboration with universities and other institutions, we will explore “seeing your wishes” for the future by incorporating knowledge from diverse fields including cognitive psychology, AI, and behavioral analysis.

- Management information

- Message from the President

- Management Policy, Management Environment, and Issues to be Addressed,etc.

- Risk Factors

- Risk Management Initiatives

- Compliance Initiatives

- Medium-Term Management Plan FY21-FY25

- Stock and bond information

- Stock Information

- Dividends and Shareholders Returns Policy

- Corporate Bond and Rating Information

- General Meeting of Shareholders

- IR Library

- IR News

- Financial Statements

- IR Presentations

- IR Calendar

- Annual report

- Seven Bank Disclosure Policy

- Other Corporate Information

- Company

- Sustainability