Registering and Using from Your PC or Smartphone

How to Register

-

-

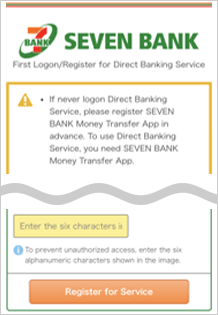

STEP1

Customer Confirmation

-

Click on the "Register for Direct Banking Service" button.

Enter the "Branch number" and "Account number" printed on the cash card.

Enter the "Registered telephone number."

Enter the same characters that are displayed in the image.

Proceed to register for the Direct Banking Service.

-

-

-

STEP2

Setting for Direct Banking Service Logon

-

Set your own "Logon ID" and "Logon password."

For customers who applied on or before October 16, 2016, procedure noted in the red frame is also required.

Enter the "Temporary PIN."

The temporary PIN will be sent from Seven Bank to your registered email address once the account application has been completed. If you forgot your temporary PIN (or if your temporary PIN has expired), a new temporary PIN will be reissued. After the prescribed procedure is completed, you will be notified of your temporary PIN by email or postal mail (postcard).

Set your own PIN for your cash card.

To verify your identity, enter your date of birth and click "Approve on the app."

-

-

-

STEP3

Authorization by app authentication.

-

Please operate on both the browser (Direct Banking) and app (International Money Transfer App).

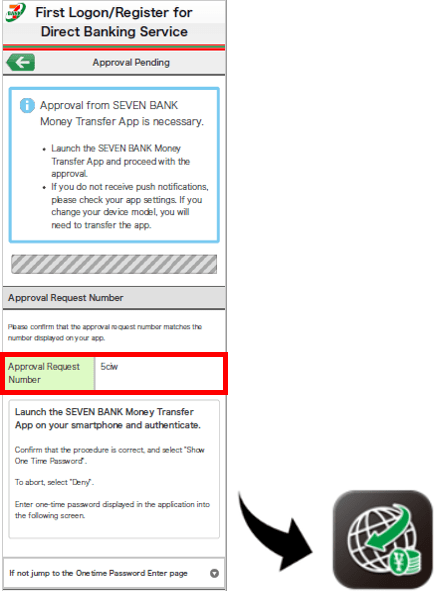

【Browser】Confirmation of approval request number

Check the approval request number displayed on the approval waiting screen of the Direct Banking Service.

Start the Money Transfer App without closing the approval waiting screen of the Direct Banking Service.

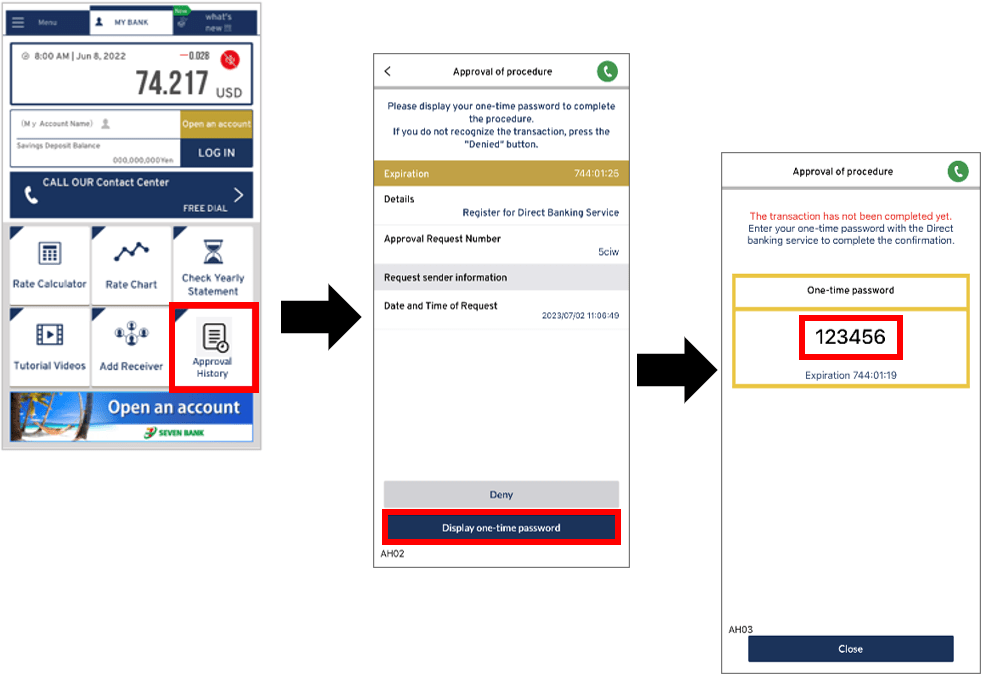

【App】Display One-Time Password

Click "Approval History" on the top screen of the Money Transfer App. Please confirm if the approval request number displayed on the screen of the app matches the approval request number indicated on the Direct Banking Service, and press "Display one-time Password".

Confirm if the One-Time Password is displayed on the screen. (There is no one-time password entry screen in the app). Switch to the Direct Banking Service registration screen within the validity period (3 minutes).

- *Please note that if you press the "Close" button, you will need to repeat the procedure from the approval request again.

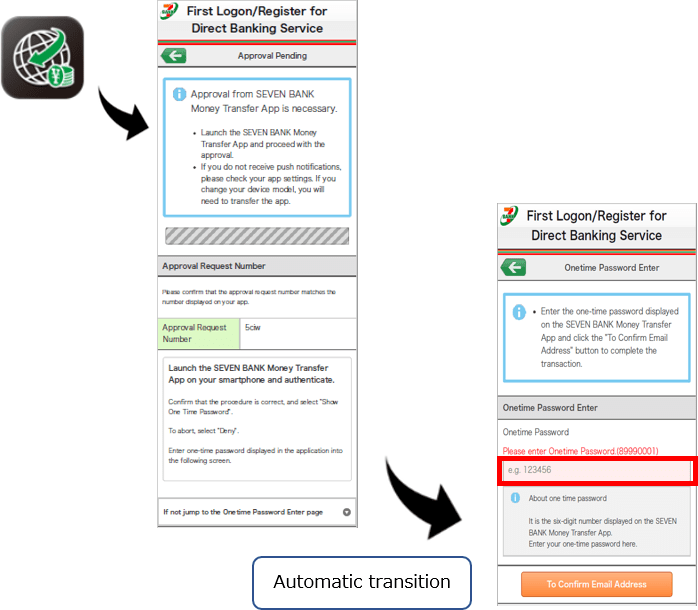

【Browser】Enter One-Time Password

Go back to the registration screen for

Go back to the registration screen for  and enter the one-time password that was displayed on the app.

and enter the one-time password that was displayed on the app. - *When the operation of

is completed, the "Approval Pending" screen of the registration will automatically change to "One-Time Password enter" screen. Please wait because it may take a few seconds for the screen to switch.

is completed, the "Approval Pending" screen of the registration will automatically change to "One-Time Password enter" screen. Please wait because it may take a few seconds for the screen to switch.

This is the end of the approval procedure. Click on "Transfer limit setting".

In addition, if the reception setting of the e-mail address has not been completed, proceed to the e-mail reception confirmation. In that case, please complete the procedure after confirming the receipt of the e-mail.

-

-

-

STEP4

Set Transfer Limit

-

Enter the transfer limit per day via the Direct Banking Service. The maximum transfer limit is 1 million Yen.

Confirm the entered information and set.

-

-

-

STEP5

Registration Completed

-

Proceed to the top page of the Direct Banking Service.

You can now begin using the Direct Banking Service.

-

How to Use

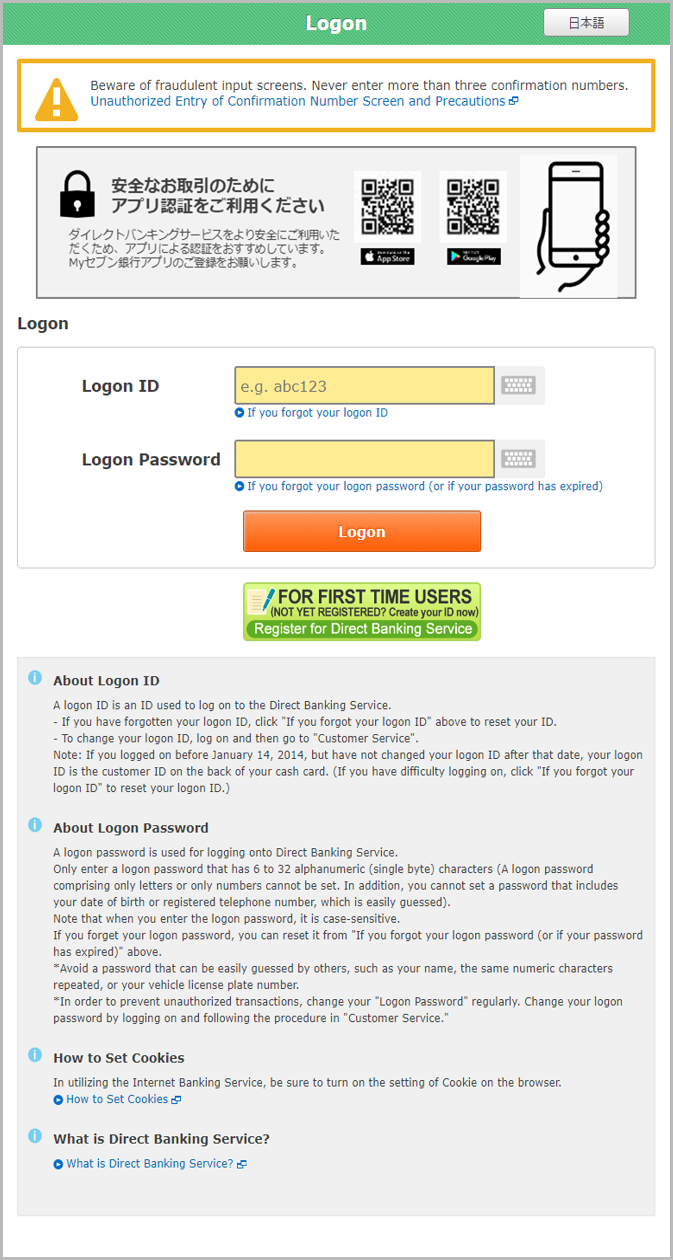

Step.1 Logon

Click on the "Logon" button to proceed to the Logon page.

Enter the "Logon ID" and "Logon password" that were registered.

Click on the "Logon" button.

Open the Seven Bank International Money Transfer App and perform approval on the screen to request approval.

Step.2 Top Page after Logging onto Direct Banking Service

Customer Page Confirmation

The previous logon date and time or the channel that was used can be confirmed.

Your favorite image or photo can be selected and used.*

3 types of buttons can be selected for the background setting.*

- *Cannot be used on a smartphone.

Message Box

Messages and notifications from Seven Bank are displayed.

- ・Note that 3 months after a message or notification is sent, it is deleted regardless if the user had logged on or not (Items that require a change procedure are not deleted).

- ・If an important notice, such as an address change, is received, follow the procedure to make the necessary changes as soon as possible.

Balance and Statement

The current "Deposit balance" and "Outstanding borrowing amount" can be confirmed.

Click on the "Ordinary Deposit" "Time Deposit" or "Card Loan" to display the most recent statement of each.

Plan and History of Money Transfer and International Money Transfer

The "Domestic money transfer" and "International money transfer" transactions that are planned or that occurred can be confirmed.

Plan Notification Function

You will receive a notification email about your registered plans (maximum of 15) on the date that was set (after 8:00 a.m.).

You may be unable to register or edit your plan in the plan notification function depending on your status.

The image that is loaded onto this page may be changed without prior notice.